With the speed of sale holding up, our latest Property Sentiment Index suggests the housing market has gathered momentum in April.

It appears sentiment in April was remarkably stable, with seller confidence improving slightly while buyer confidence declined the same amount. Could this be a sign that the tides are turning on what has been a dominant buyers’ market over the course of the last year?

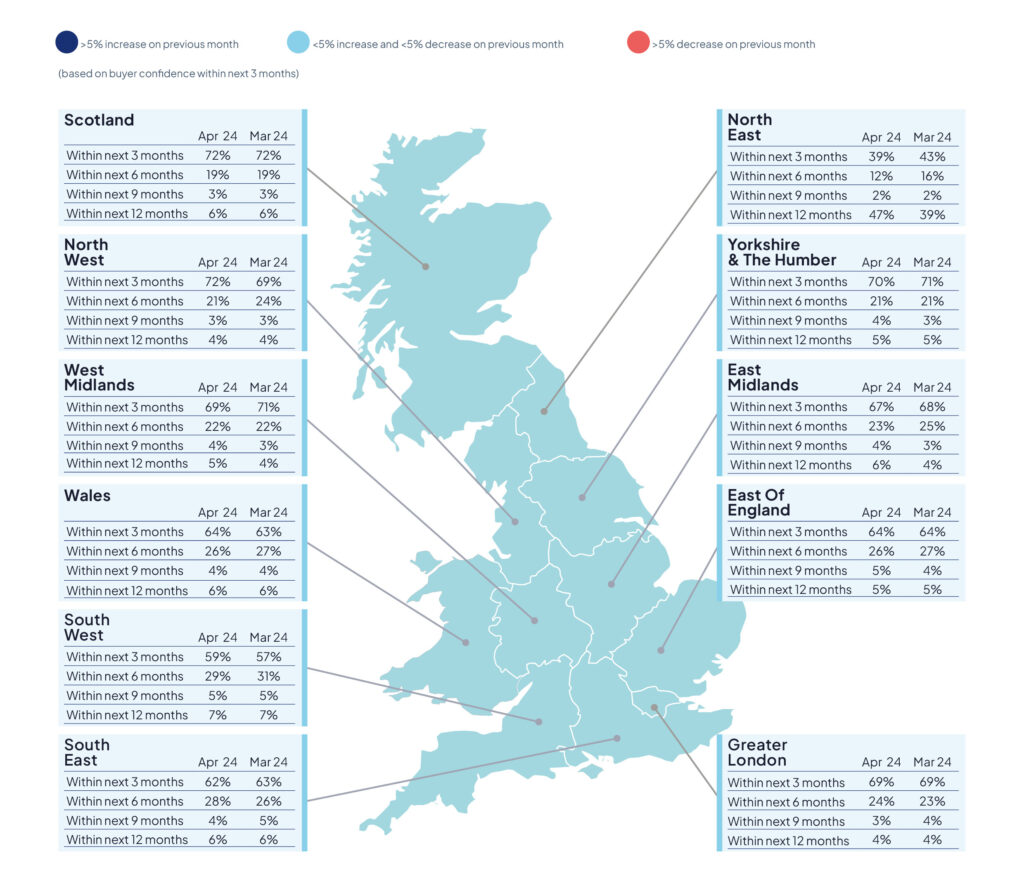

- 64% of active buyers in the UK were confident that they would purchase a property within the next 3 months

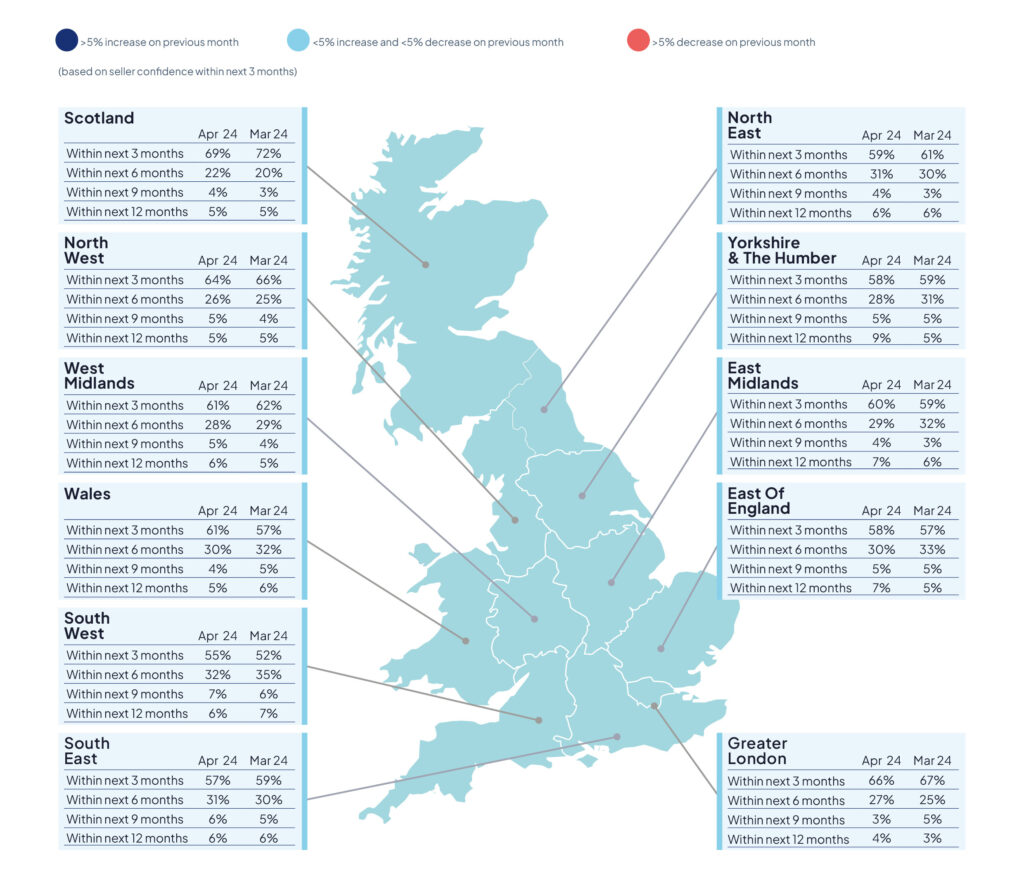

- 61% of sellers in the UK were confident that they would sell their property within the next 3 months

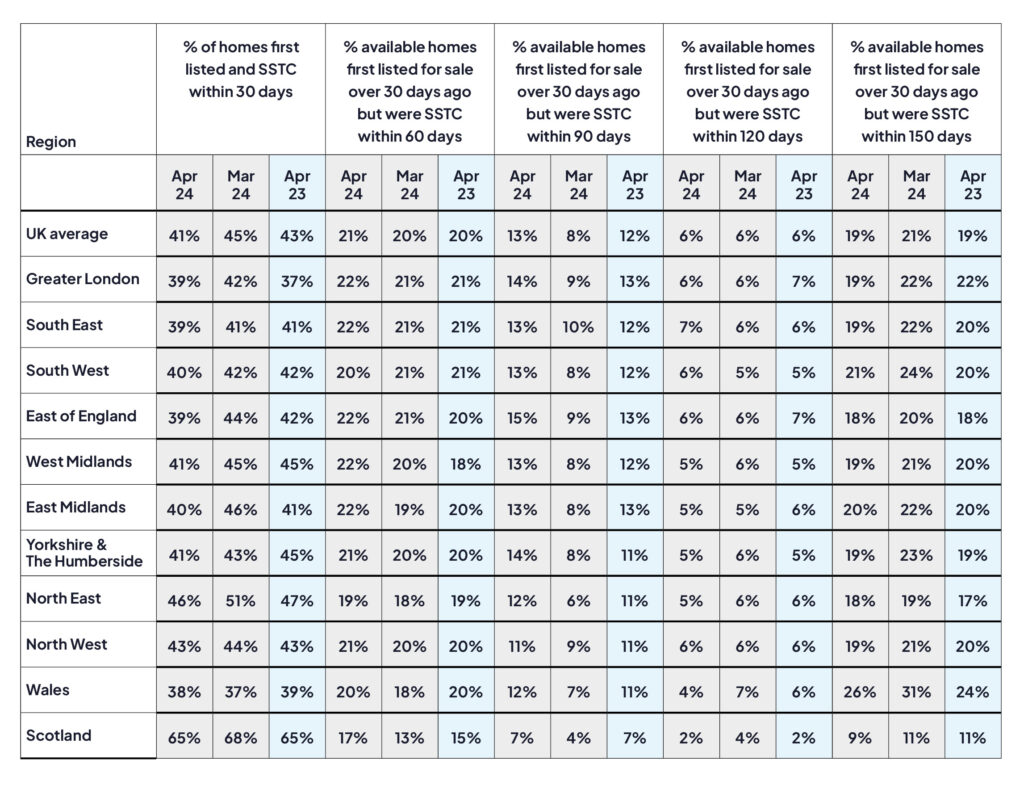

- 41% of properties were Sold Subject to Contract (SSTC) within 30 days of first being advertised for sale, compared with 45% in March 2023

- Speed of sale is holding up after sluggish market activity towards the end of last year

Our President, Jason Tebb, discusses the insights from our latest report:

Housing market activity gathered momentum in April as the weather finally started to improve, stock levels rose, and new buyer enquiries picked up. However, less welcome was the increase in mortgage rates as lenders, who until now have been absorbing the rising cost of funding, passed some of this onto borrowers.

This increase in mortgage costs for those already facing affordability constraints has been confusing and unhelpful as many have been expecting a reduction in base rate after several holds at consecutive Monetary Policy Committee meetings. However, hopes of base rate cuts have rescinded in recent weeks, with markets which previously forecasted several base rate reductions this year now suggesting there may be only two or three at most. This has pushed up Swap rates, which underpin the pricing of fixed-rate mortgages, resulting in lenders increasing their mortgage rates.

Time will tell whether higher mortgage costs persist and negatively impact buyer confidence. As far as April is concerned, sentiment was remarkably stable, with seller confidence improving slightly while buyer confidence declined by the same amount. 61% of sellers were confident they’d sell within three months, a slight improvement on March’s 60%. Meanwhile, 64% of UK buyers were confident they’d purchase a property within the next three months, down slightly from March’s 65%.

Buyer and seller confidence has diverged over the past six months: in October, 72% of buyers were confident they’d buy within three months, compared with 58% of sellers confident they’d sell within the same timeframe. Since then, seller confidence has improved while buyer confidence has waned, with a rebalancing from what was a bullish buyer’s market in the latter part of last year to a more level playing field. Buyers appear less certain of the strength of their position, which may have something to do with the uncertainty that continues to prevail – not just with interest rates, inflation and when an election will be called in the UK – but also wider international concerns.

With Nationwide Building Society reporting a slowing in annual house price growth in April, buyers are not prepared, or able, to pay any price to secure a property. Nationwide also reports that half of those considering buying a home in the next five years have delayed their plans over the past year. While some agents report competition and bidding wars for desirable properties in areas where stock is scarce, others suggest buyers are bargaining hard, with those reliant on mortgages mindful that borrowing is more expensive so buying a property will cost them more. Mortgage sentiment remained steady, with 7% very worried or slightly concerned about getting a mortgage in April compared with 9% in March, suggesting this isn’t the driver of waning buyer confidence.

41% of all properties were SSTC within 30 days of first being advertised for sale in April, down from 45% in March, but an improvement on six months ago, when it was 36% in October. The sluggish market at the end of last year has undergone a steady recovery, buoyed by cheaper mortgage rates and increased optimism. The boom-and-bust of old has gradually been replaced with incremental changes and adjustments, more sensible pricing and buyers prepared to negotiate hard, particularly in light of higher borrowing costs. It’s a good time to buy and sell, before the date of the general election is announced and uncertainty prevails once more.

State of the Nation

Once again, we’re including views from agents across the country in this month’s Property Sentiment Index (see page 8),which reaffirm a pick-up in activity in April as buyers and sellers remain broadly optimistic and pricing impacted by demand and property availability in that area.

Alan Cumming of Aberdein Considine in Scotland remarks that most areas are seeing a “surge in new properties being listed for sale… [and] increased viewing numbers”.

Prices are rising in some areas but not all. Stuart Matthews of Miller Metcalfe in the North West, says “property prices remain static with only slight increases in some of the more popular locations”. He notes that the general election may cause some uncertainty so “sellers must consider and assess pricing strategies to maximise returns”.

Angi Cooney at C Residential in the West Midlands has also seen a “steady increase in property prices, with an average growth of 2.5% compared to the previous month”. She notes that it is a “seller’s market” in Staffordshire, thanks to the lack of property for sale, with “bidding wars becoming increasingly common”.

Over in Wales, Melfyn Williams of Anglesey & Gwynedd, is enjoying a “vibrant and buoyant market” with properties selling well at auction: “attractively priced properties are not only selling well but achieving bids around a third over their guide price” which he attributes to “savvy buyers… ready to snap up a good deal”.

In the North East, John Nicholson of Dowen Auction, Sales and Lettings, points to the “looming prospect of rate cuts” which he believes “cast a shadow over prospective buyers, causing some to adopt a wait-and-see approach”. A persistent shortage of properties, “coupled with sustained demand, has created a competitive environment where properties often attract multiple offers and sell swiftly”. Finally, in the East Midlands, Neill Millward of Robert Ellis is optimistic about the housing market over coming months, thanks to seasonal fluctuations: “as we move into summer, we anticipate an increase in the number of sales agreed…[presenting] both opportunities and challenges for buyers and seller alike, as heightened competition may include pricing and negotiation dynamics”

You can read the full report here.