In March, we launched our new Hotspots report which has been designed to explore the hottest property markets across the UK based on supply and demand for the properties across different areas.

Our Hotspots ranking data is calculated by looking at the number of available sales properties within a certain area and comparing that against the volume of onsite activity over the same period to create a score that is representative of the intensity of interest in that market.

Areas are ranked by this score and this score is compared across different time periods to show how the “heat” of the market is changing over time.

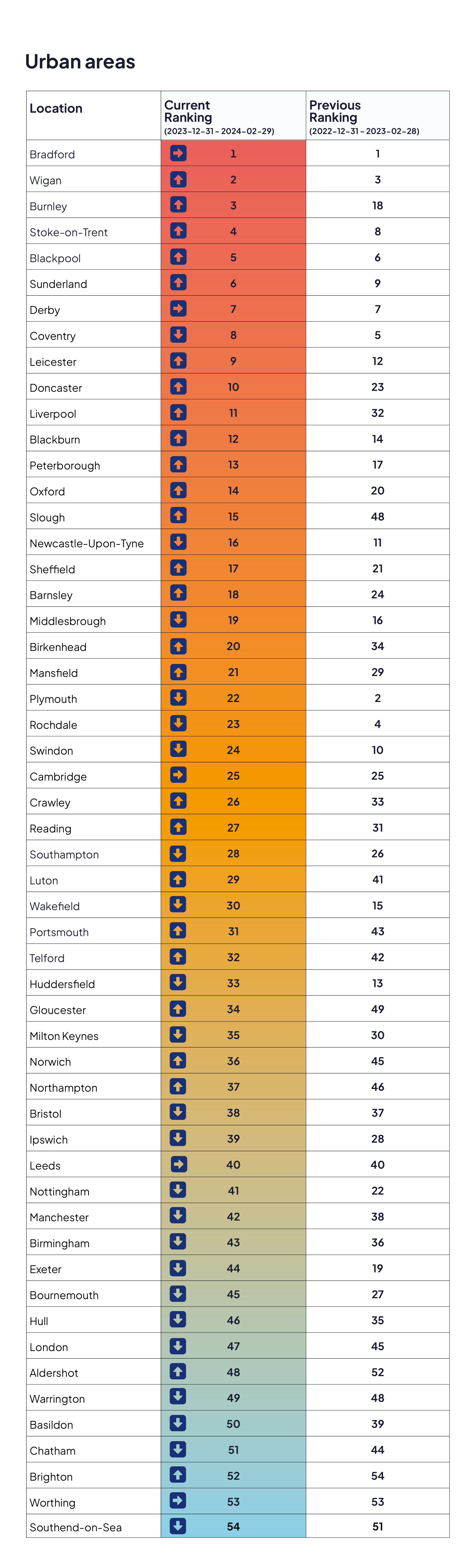

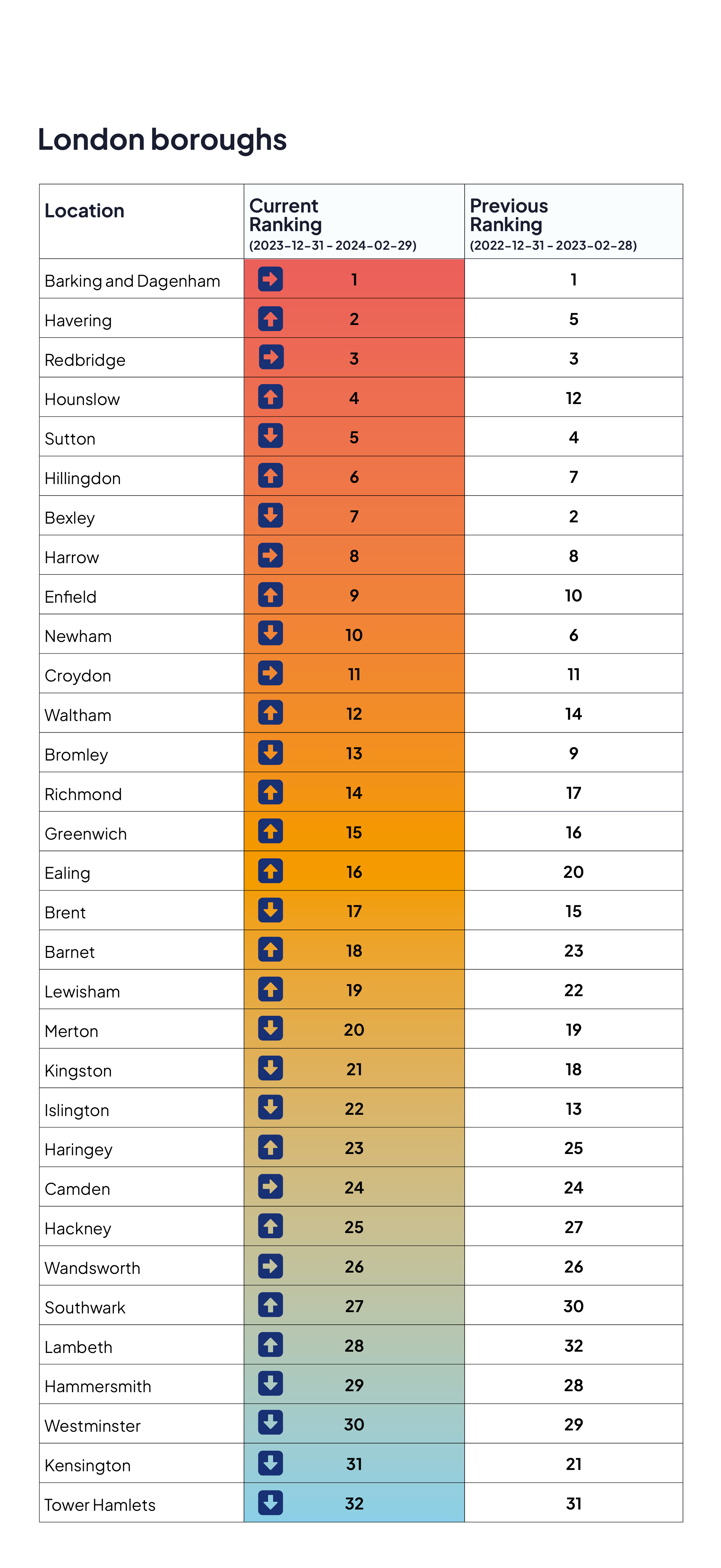

The March report showed that the hottest urban area in the UK in the first three months of 2024 was Bradford while the hottest London borough was Barking and Dagenham.

Commenting on the report, Jason Tebb, President of OnTheMarket, says: “Many factors go into shaping the decision to buy a home in a particular area, with proximity to family and friends, work, and schools just some of the many considerations. As property price increases have outstripped wage rises, affordability has increasingly influenced that decision-making, especially with high interest rates and a cost-of-living crisis thrown into the mix. Making the numbers add up has not only acutely impacted where movers choose to live but whether they may be able to buy at all.

Our Market Hotspots index suggests buying decisions are heavily influenced by affordability with some of the cheapest locations seeing the most activity. It is no coincidence that the average property price in all bar one of the ten hottest urban areas is below the national average. There are also suggestions of a ripple effect at work with people priced out of major cities opting for cheaper urban areas within easy commuting distance. Hence, Bradford, the top hotspot for the second year in a row, is close to Leeds while second-placed Wigan is midway between Manchester and Liverpool, and third-placed Burnley is north of Manchester. Post-pandemic, people seem willing to commute that little bit further than they might have previously, while more flexible working conditions mean they may not be required to be in the office every day. This is making areas outside the major cities increasingly popular with property buyers as there is more value to be had.

The north/south divide is also in evidence, with all of the top ten hottest urban areas in the north of England or the Midlands. London is in a lowly 47th place, down from 45th when looking at the same period last year even though average property prices haven’t risen as much as in other parts of the country. The index further reinforces that many buyers are being priced out of London and the southeast and as a result may be looking for opportunities further afield.

Within London itself, it’s a similar story with the strongest purchase activity in cheaper boroughs while pricier boroughs are not as busy. Barking & Dagenham is London’s hottest market, with an average property price higher than the national average but significantly lower than many of the more expensive London boroughs. Given that it is several miles to the east of central London, commuting is straightforward, and urban regeneration is offering community links and more affordable housing options than can be found in the centre. Meanwhile, Westminster and Kensington hover near the bottom of the table, with average property values roughly several times the value of those in Barking & Dagenham. With the average property price in every top ten borough on our list below the London average, it suggests making the jump from renting to owning is more achievable than in more expensive boroughs.

While much is made of how the British are falling out of love with buying property and will be satisfied with long-term renting, like our European counterparts, our data suggests this isn’t the case. We are a nation of aspiring homeowners rather than renters, with people prepared to gravitate to a cheaper area if it means being able to buy their own home. If that area has good transport links and amenities, it’s going to be popular with others in the same position, pushing up prices over time and pricing people out as gentrification takes hold.

People are buying in areas that are relatively affordable and cheaper than average in the hope that one day they may get close to the average property price or even exceed it. Therein lies the opportunity for property buyers, with hotspots further down the list offering possibilities for those looking to purchase but seeking better value and avoiding competing with quite so many other would-be purchasers.”