Despite the usual concerns around the upcoming general election, our latest Property Sentiment Index suggests that buyer confidence increased significantly in May.

Buyer sentiment was on the up and seller confidence also increased, though less dramatically, improving by a couple of percentage points. What does this show of both buyer and seller confidence mean for the housing market in the coming months?

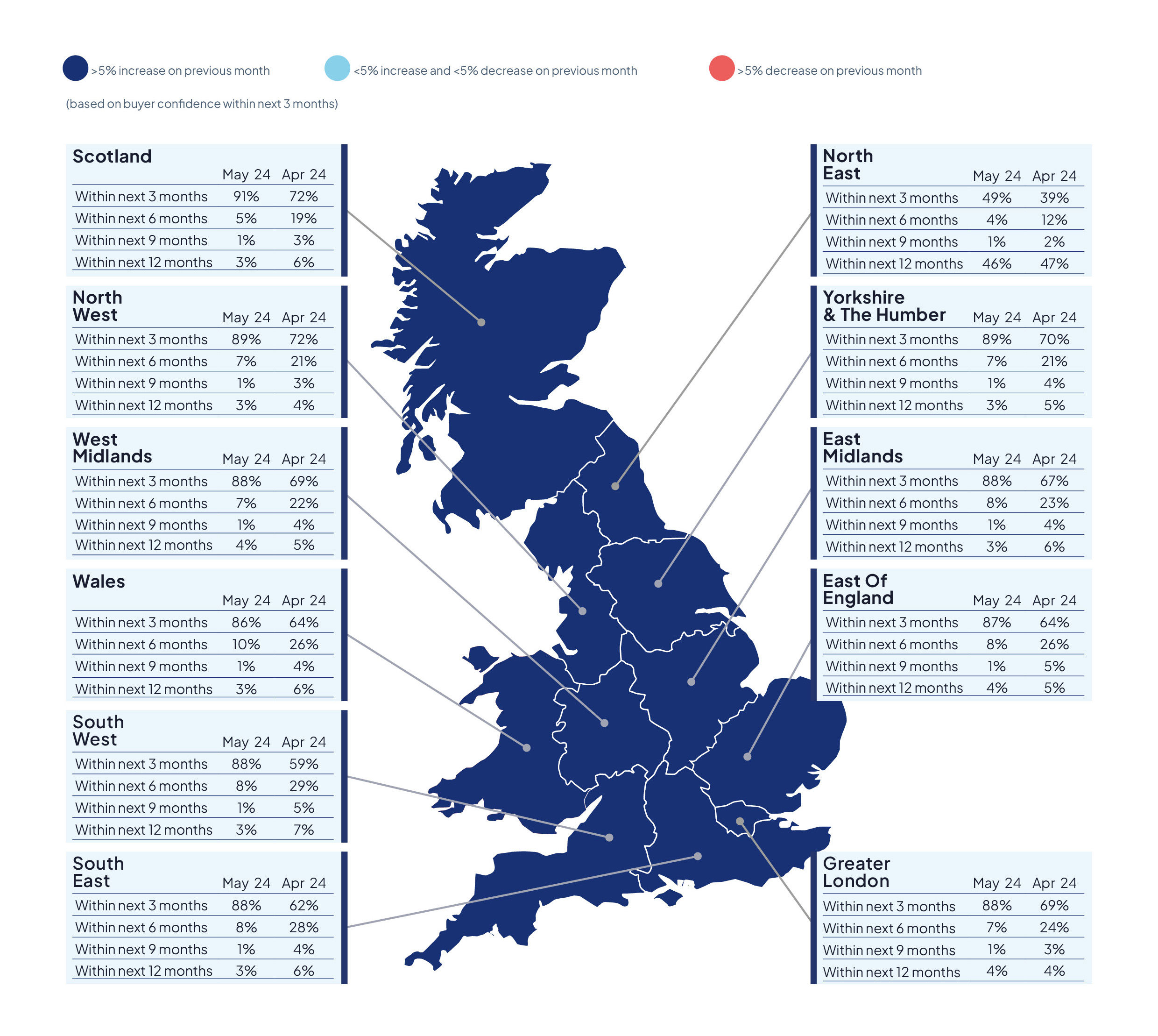

- 85% of active buyers in the UK were confident they would purchase a property within the next 3 months

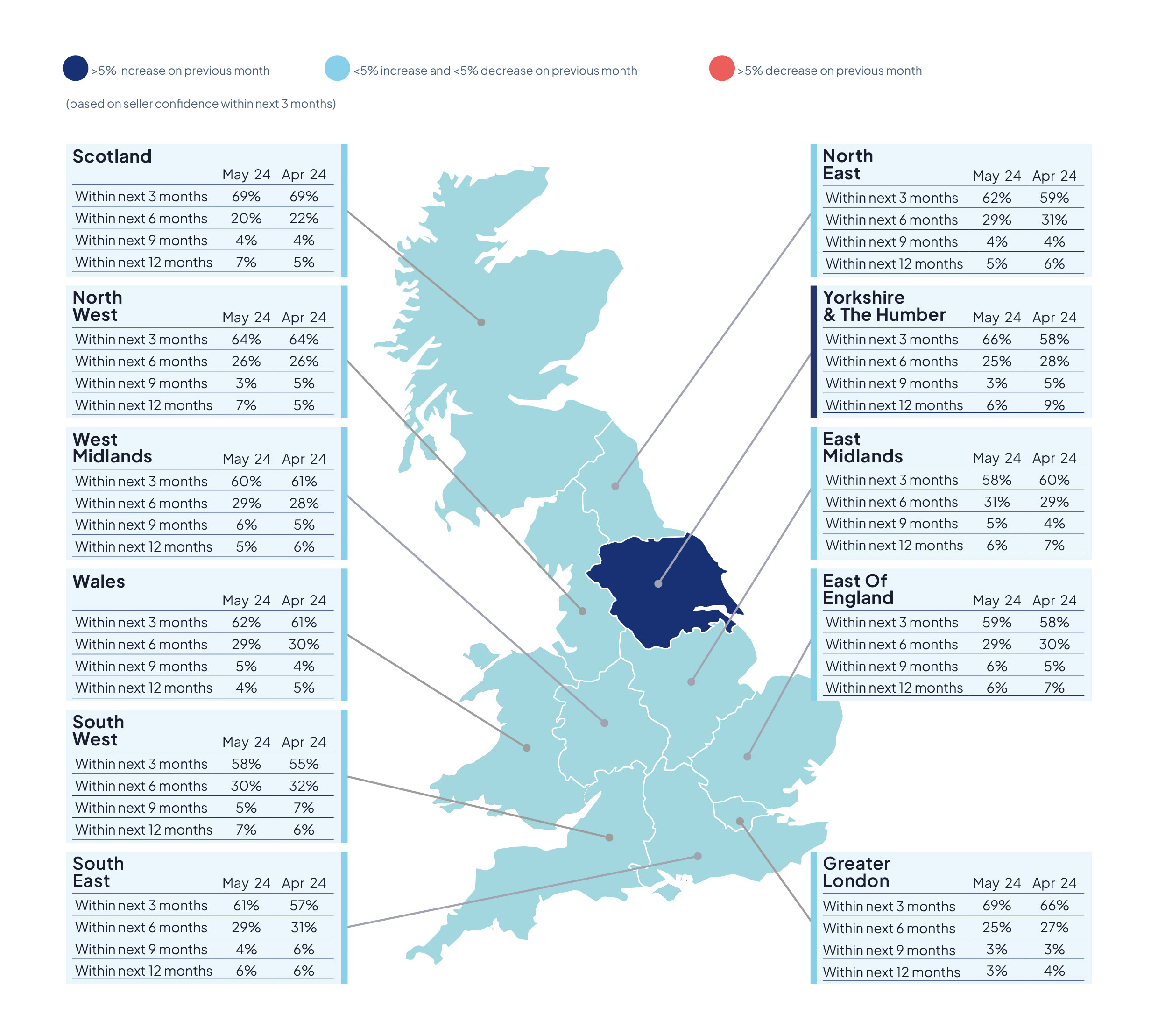

- 63% of sellers in the UK were confident they would sell their property within the next 3 months

- 43% of properties were Sold Subject to Contract (SSTC) within 30 days of first being advertised for sale, compared with 32% in January 2023

- Buyers factoring in higher borrowing costs and remain sensitive on price

Our President, Jason Tebb, discusses the insights from our latest report:

Despite the looming general election, the housing market is bucking the trend, apparently shrugging off any concerns about the prospect of a change in government, with no evidence of a slowdown in activity or buyers and sellers putting decisions on ice. Indeed, our data shows that May saw a significant surge in buyer sentiment to the highest level seen this year, soaring to 85% from April’s 64%. It is testament to the remarkable resilience of the housing market that 85% of active buyers were confident they’d buy within three months. A surge in market activity, more stock becoming available, improving weather conditions, and inflation moving in the right direction mean buyers feel they are in a strong position and able to proceed with their purchases in a timely fashion.

The continuing decline in inflation, edging closer towards the Bank of England’s 2% target, has boosted expectations of an impending interest rate cut. Whether that will come at June’s meeting or later in the summer, only time will tell, but there is an overwhelming sense that rates have topped out, making it easier for buyers to budget and plan, confident in what they can afford. Higher mortgage rates are being factored into budgets and affordability calculations, but this does mean there is a limit on what buyers are prepared or able to pay. Various house-price indices have recently underlined this, with average prices flat or edging up slightly, reflecting the fact that buyers remain sensitive on price.

Seller sentiment, while perhaps not as buoyant as buyer confidence, nevertheless is also on the rise, with 63% of sellers confident they’d sell within three months in May compared with 61% in April and 55% in December. It is encouraging that, like buyers, sellers do not seem concerned about a general election impacting their chances of transacting in the coming quarter. Elections are renowned for introducing uncertainty and pausing activity in the housing market, until it is known who is forming the new government and what its initial plans are. But this election does not seem to be causing indecision as the outcome is not only considered by many to be a foregone conclusion but also not one of particular concern to the market. There is a sense that many have put decisions on hold for long enough while interest rates have risen or been held and are now understandably keen to get on with their lives.

The worst of the nervousness about the market seems to be behind us as levels of properties Sold Subject to Contract within 30 days of first being listed were slightly higher at 43% in May than April’s 41% and last May’s 42%. When you consider that this figure fell to a low of 32% in December, it is evident that there has been some volatility along the way. The sluggish market activity seen at the turn of the year is giving way to more optimism and an increase in purpose. We await with interest to see whether May’s improvement in buyer confidence translates into improved SSTC figures in coming months as this sentiment feeds through to actual transactions.

Ultimately, this feels like quite a healthy market as we head towards summer, with activity and transactions picking up, interest rates poised to come down and property prices not running away with themselves. As far as prices are concerned, this is good news in particular for first-time buyers and sellers keen to get a foothold on the property ladder or edge up it, which in turn facilitates transactions further up the chain.

State of the Nation

As usual, we welcome views from agents across the country in this month’s Property Sentiment Index.

In the South West, Oliver Jenkin of Cooper and Tanner has noticed that, while there has been much more interest in buying property this year, getting to exchange is taking longer: “Our main issue has been getting sales through to exchange, which is taking longer than I can ever remember. Average sale-to-exchange timescales are now exceeding 14 weeks on a regular basis.”

Over in Nottingham, Neill Millward at Robert Ellis notes a positive outlook for the property market with “an uptick in higher property sales, a trend typically seen with the arrival of the summer months”. However, there are potential issues ahead with “challenges such as affordability and supply constraints” which could impact growth. He feels the upcoming election could play a significant role in shaping the property market, “with potential changes in policies affecting housing and investment”.

You can read the full report here.