With the promise of spring and stock levels at their highest for at least two years, our latest Property Sentiment Index suggests the housing market continued to stabilise in March.

It appears property seekers remained keen to get on with the business of moving in March with active UK buyers and sellers confidence levels that they’d move within the next three months remaining unchanged when compared to February as buyer confidence remained at 65% and seller confidence stayed consistent at 60%.

- 65% of active buyers in the UK were confident that they would purchase a property within the next 3 months

- 60% of sellers in the UK were confident that they would sell their property within the next 3 months

- 45% of properties were Sold Subject to Contract (SSTC) within 30 days of first being advertised for sale, compared with 45% in March 2023

- Buyers and sellers wise to transact before the distraction of a general election

Our President, Jason Tebb, discusses the insights from our latest report:

The housing market continued to stabilise in March, with an early Easter, clocks going forward and promise of better weather (even if it doesn’t feel as though we are quite there yet) boosting activity levels and boding well for the traditionally busier months of April and May. With stock levels at their highest level for at least two years and a more optimistic outlook with regard to interest rates, there are opportunities for buyers and sellers keen to move, although price sensitivity remains an issue.

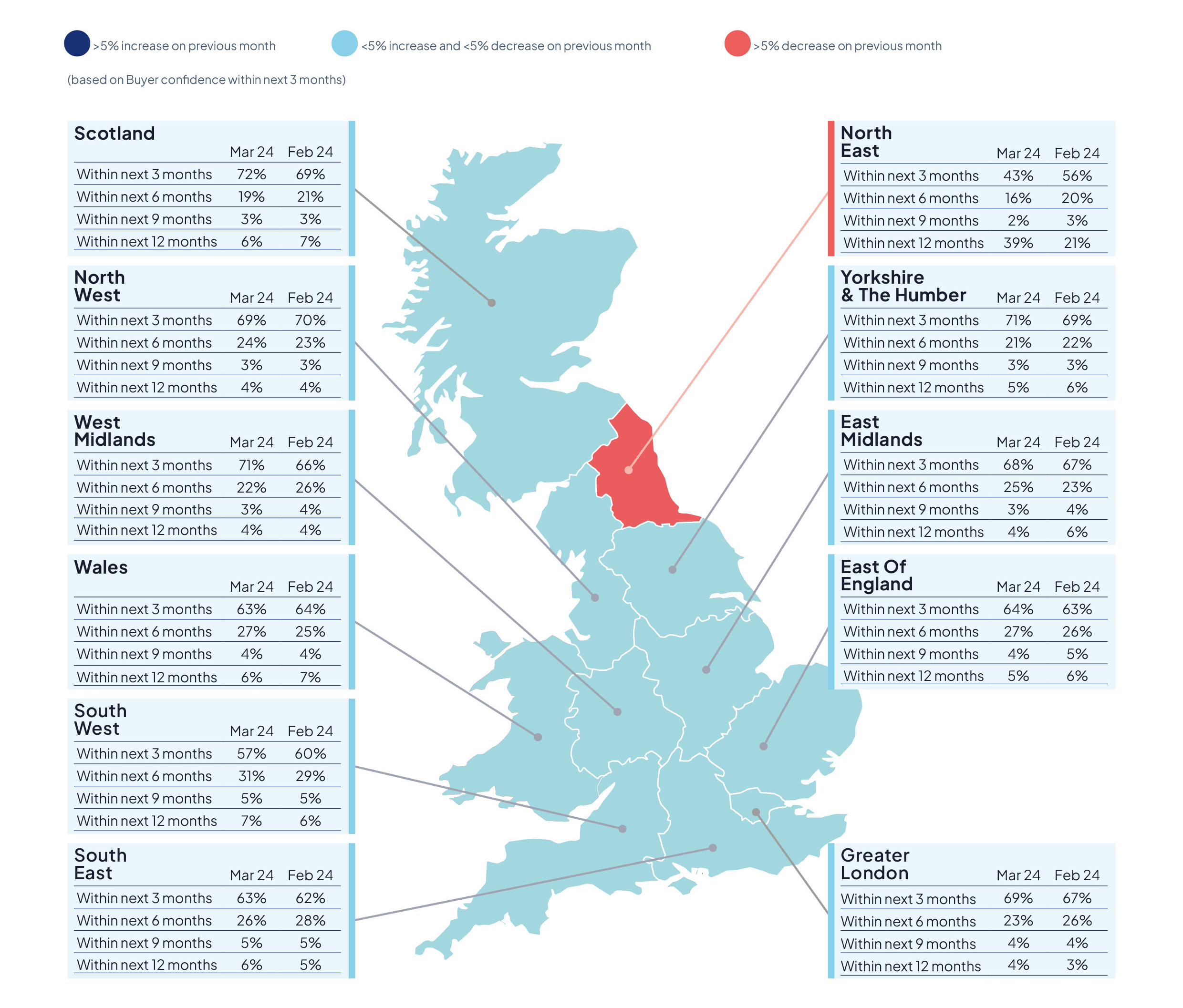

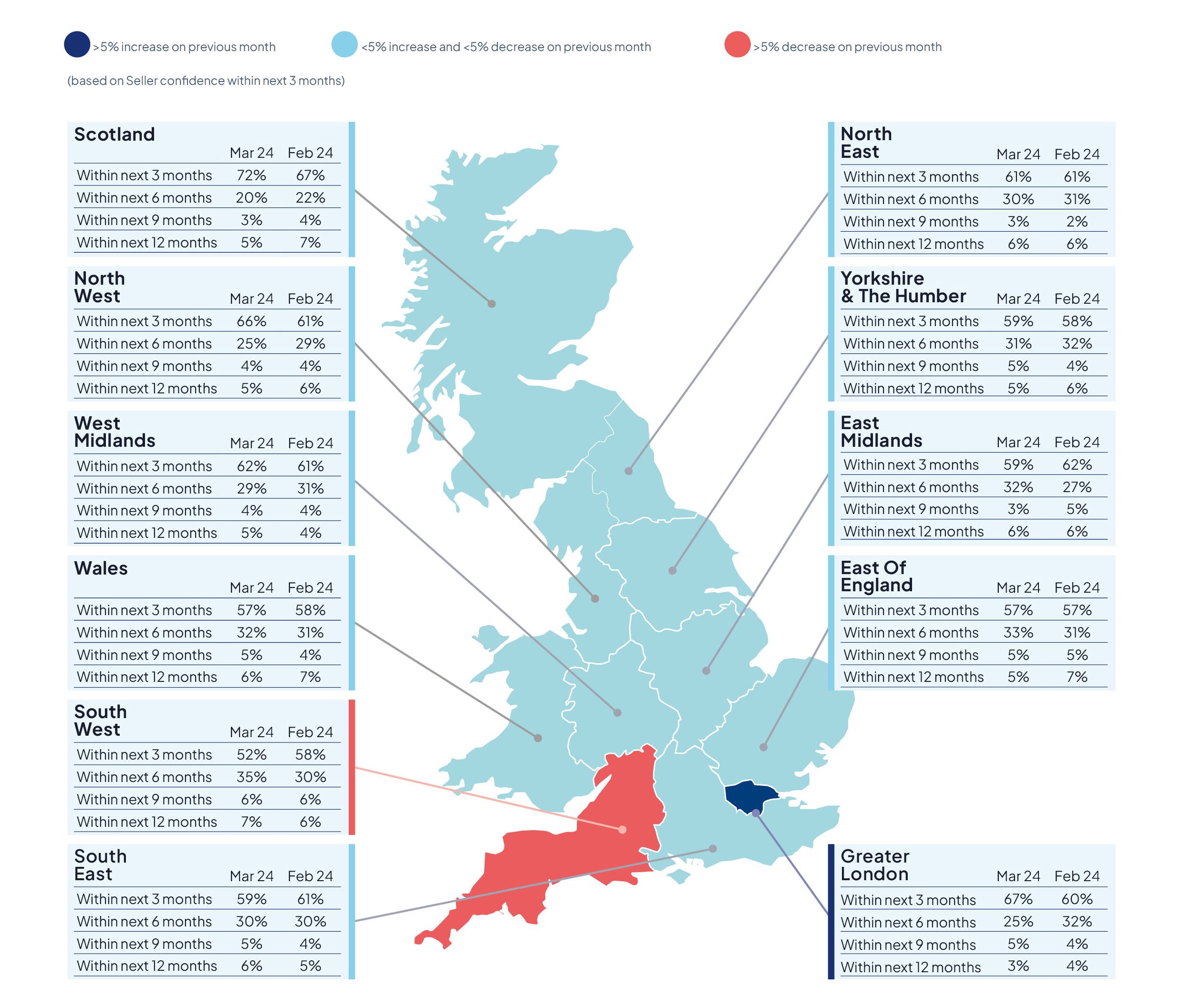

Our data shows that buyer and seller confidence were unchanged in March. Some 65% of UK buyers were confident they’d purchase a property within the next three months, unchanged from January and February. Meanwhile, 60% of vendors were confident they’d sell within three months, also consistent with February. However, it is worth remembering that there is no single picture when it comes to the housing market, with regional variations proving to be significant. Hence the 13 percentage-point drop in buyer confidence in the North East (from 56% to 43%), while seller sentiment saw a 7 percentage-point increase in London (from 60% to 67%). These regional ups and downs underline the importance of sellers taking advice from an experienced local agent who really understands the ins and outs of their local market, particularly when it comes to pricing.

Average national property prices dipped slightly in March compared with February, according to both Nationwide and Halifax house price indices, suggesting that we haven’t returned to the runaway housing market of the past, with buyers still impacted by affordability concerns and not prepared to pay any price to secure a home. With more stock coming to market, and buyers having to get used to higher borrowing costs, this should hold prices in check, which will be good news for first-time purchasers in particular.

With the fifth rate hold in as many meetings of the Monetary Policy Committee in March, the conviction that there will be no further increase in rates and that the next move will be downwards, is growing all the time. Borrowers grew slightly more concerned about mortgage pricing in March, with 9% very worried or concerned compared with 8% in February but this could be down to the perception that the first cut in interest rates may not happen as soon as many thought at the start of the year. As inflation continues to move in the right direction, there are reports that some buyers are holding off and waiting until that first rate reduction before making a move.

While this approach may be understandable, there is a limited timeframe to transact before the general election. History tells us that market activity tends to slow the closer we get to a general election, with the uncertainty resulting in buyers and sellers holding off until the outcome is known. Those keen to buy or sell this year may therefore want to get on with it sooner rather than later, particularly as the first quarter is already behind us and transactions can take longer than expected. While the prospect of lower interest rates is tempting, no-one knows when this will happen and hesitating now could mean missing out on the best time of year to buy and sell property. It may make sense to pay a little more on the rate and make hay while the sun shines, rather than worrying about a quarter-point reduction at some point and attempting to transact in quarters three or four when there is also the distraction of a general election to contend with.

State of the Nation

Once again, we’re delighted to include views from agents across the country in this month’s Property Sentiment Index (see from page 8), which reaffirm a cautious optimism in March as buyers remain price sensitive.

Mike Cleary of Sheldon Bosley Knight in the West Midlands believes buyers are waiting for an interest rate reduction before making their move. “The forecast remains positive, however, with inflation falling which will surely be followed by interest rates. The optimist says people arewaiting for the first drop in rates in the hope of being able to borrow more,” he says.

Over in Scotland, David Corrie of Galbraith notes that the market is picking up, along with the weather: “New listings are accelerating rapidly and the early Easter at the end of March appears to have spurred sellers into taking action early.” But he warns sellers to be sensible on pricing: “Pricing is key. Where a price point is missed because of high comparable data from the heady 2021/22 period or over ambition, property can linger on the market longer than expected.”

Andrew Cardwell of Cardwells Estate Agents in the North West, agrees: “The March sales market… has been shaped by an underlying element of cautious optimism juxtaposed with a tangible price sensitivity to demand. In the most basic terms, sellers and buyers either want (or need) to move, and are getting on with it, but not at any cost.”

You can read the full report here.