Following on from the Bank of England’s decision to hold interest rates in September, our latest Property Sentiment Index suggests that a sense of stability in the housing market was reinforced and carried through in October.

Sentiment among buyers and sellers stayed strong during October despite ongoing wider economic challenges with 72% of active buyers confident they’d purchase a property within the next three months in, compared to 74% in September. Meanwhile, 58% of sellers were confident they’d sell their property within three months, only a slight decrease when compared to 61% in September.

- 72% of active buyers in the UK were confident that they would purchase a property within the next 3 months

- 58% of sellers in the UK were confident that they would sell their property within the next 3 months

- 36% of properties were Sold Subject to Contract (SSTC) within 30 days of first being advertised for sale, compared with 60% in October 2022

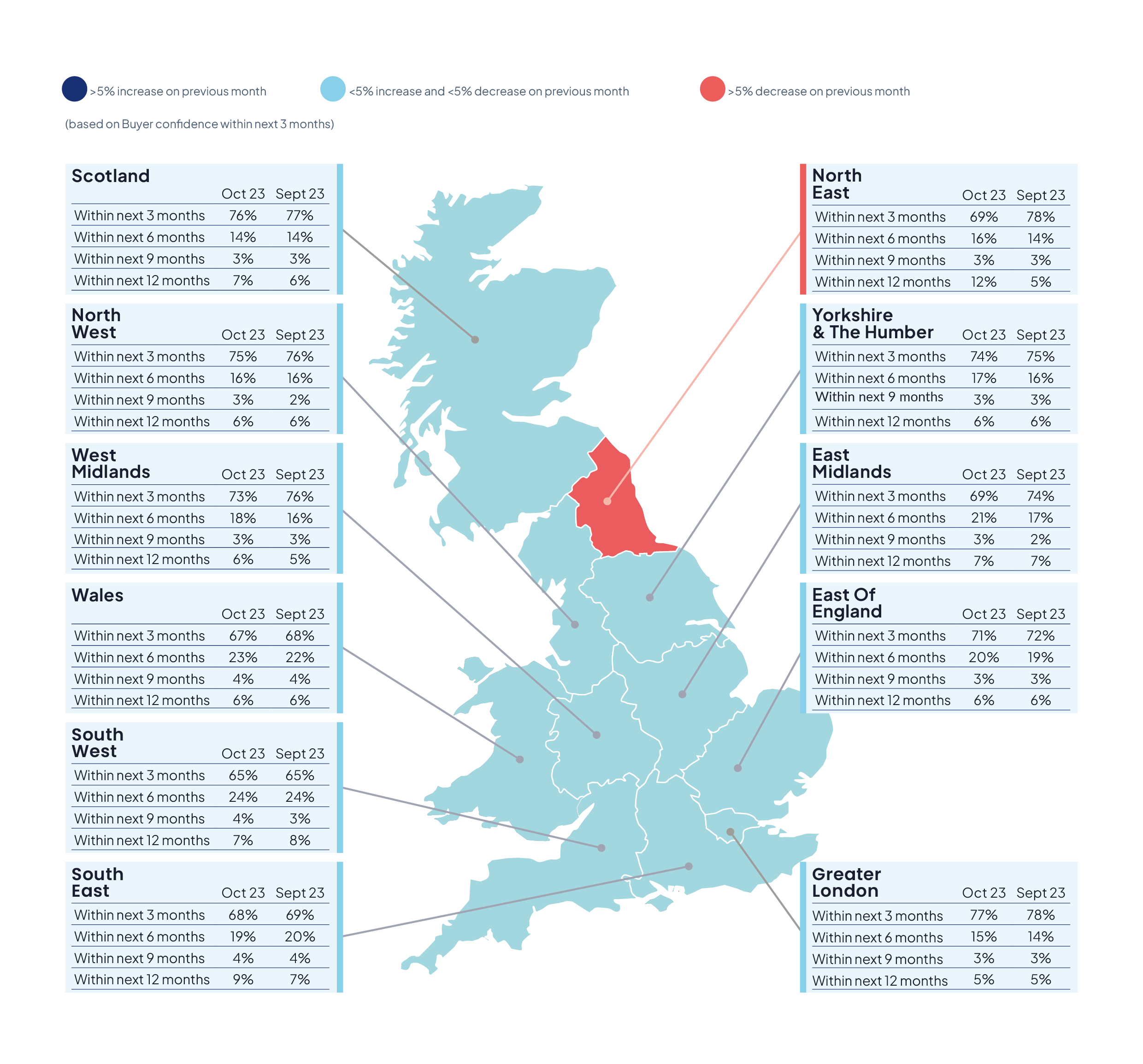

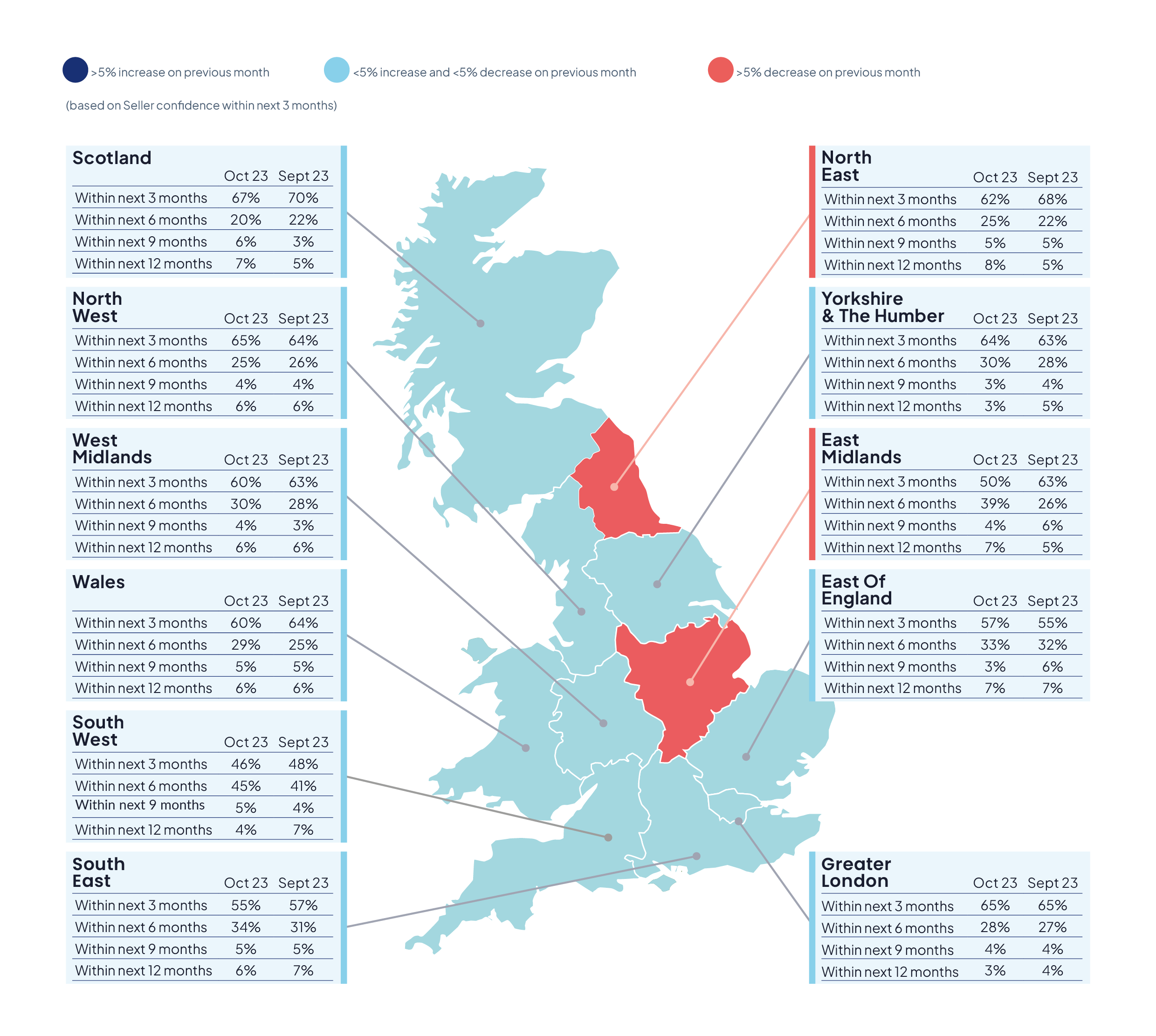

- Growing regional differences emerge with confidence dipping in some areas more than others

Our Chief Executive Officer, Jason Tebb, discusses the insights from our latest report:

The national housing market remained resilient and stable in October, all the more remarkable given the ongoing economic headwinds, high cost of living and elevated mortgage rates. The Bank of England’s decision to hold interest rates in September (and again in November at the time of writing) is playing a big part in that. After 14 consecutive rate hikes, borrowers have finally been able to breathe a welcome sigh of relief and dare to hope that rates may have peaked. Even if another rate rise is required to keep inflation in check, there’s a growing perception that the worst is behind us, although borrowers will have to get used to paying more for their mortgages than in recent years.

Our data shows that on the whole, buyer and seller sentiment was stable in October. Just under three-quarters of buyers (72%) were confident that they’d purchase a property within the next three months compared to 74% in September. Seller confidence also dipped slightly, with 58% of UK sellers confident that they’d sell within the next three months in October, down from 61% in September. Further stability is in evidence with just over a third of properties (36%) Sold Subject to Contract within 30 days of first being listed in October, down slightly from 37% in September 2023. However, this number is well below the 60% recorded in October 2022, when the market was significantly more buoyant before the fallout from Prime Minister Liz Truss’ ill-fated mini-Budget.

While the overall picture is one of stability and consistency, the housing market is not a single entity but made up of many regional markets, as evident in October’s data. Drill down to the regions and there are some significant variations. For example, in the North East there was a 9 percentage-point decrease in buyer confidence in October with 69% of buyers confident that they’d purchase a property within the next three months compared with 78% in September. Over in the East Midlands, the drop was gentler, with a 5 percentage-point decrease in buyer confidence (69% in October compared with 74% in September). Similarly, seller confidence was hit hard in certain regions with a 13 percentage-point drop in seller confidence in the East Midlands in October (50% compared with 63% in September) and a 6 percentage-point drop in the North East (62% in October, down from 68% in September). Regional variations in sentiment are down to diverse dynamics, impacted by a whole host of factors ranging from demand to local infrastructure, property prices, stock levels, and whether stretched affordability and salaries are more of an issue than elsewhere.

While the overall picture is one of stability and consistency, the housing market is not a single entity but made up of many regional markets, as evident in October’s data. Drill down to the regions and there are some significant variations. For example, in the North East there was a 9 percentage-point decrease in buyer confidence in October with 69% of buyers confident that they’d purchase a property within the next three months compared with 78% in September. Over in the East Midlands, the drop was gentler, with a 5 percentage-point decrease in buyer confidence (69% in October compared with 74% in September). Similarly, seller confidence was hit hard in certain regions with a 13 percentage-point drop in seller confidence in the East Midlands in October (50% compared with 63% in September) and a 6 percentage-point drop in the North East (62% in October, down from 68% in September). Regional variations in sentiment are down to diverse dynamics, impacted by a whole host of factors ranging from demand to local infrastructure, property prices, stock levels, and whether stretched affordability and salaries are more of an issue than elsewhere.

Despite softer sentiment and confidence in some areas, the overriding sense is that people are breathing a sigh of relief. The pause in rate rises enables consumers to reassess where they stand, giving them the confidence to get out there with the intention of buying or putting property on the market to sell. The improving attitudes towards getting a mortgage (4% of UK movers were worried or slightly concerned about getting a mortgage in October, compared with 6% in September) further suggest that the pause in rate rises could turn out to be highly significant. With Nationwide reporting a slight rise in average property prices in October, the market continues to tick along.

Despite softer sentiment and confidence in some areas, the overriding sense is that people are breathing a sigh of relief. The pause in rate rises enables consumers to reassess where they stand, giving them the confidence to get out there with the intention of buying or putting property on the market to sell. The improving attitudes towards getting a mortgage (4% of UK movers were worried or slightly concerned about getting a mortgage in October, compared with 6% in September) further suggest that the pause in rate rises could turn out to be highly significant. With Nationwide reporting a slight rise in average property prices in October, the market continues to tick along.

State of the Nation

Once again, we’re delighted to include views from agents across the country in this month’s Property Sentiment Index (see pages 8 onwards).

Stormy weather and the clocks going back had an impact on market activity in October with John Nicholson at Dowen Auctions, Sales & Lettings in the North East remarking: ‘the changing seasons have brought about a noticeable slowdown in activity… the damp and chilly autumn weather has made it less enticing for homeowners to list their properties, and potential buyers less inclined to engage in house-hunting’. However, he is seeing market resilience, observing that ‘home values have managed to hold steady’, putting this down to ‘enduring demand for housing in the region, bolstered by the government’s affordable housing initiatives and population growth’.

While our data shows reductions in buyer and seller confidence that they’d move in the next three months in the East Midlands, Neill Millward of Robert Ellis Estate Agents remarked that sentiment in the region ‘appears to be relatively stable’. In addition, positive signs for the market are highlighted by a ‘significant number of new first time buyer applicants registering for property searches’; although he also acknowledges ‘the increase in borrowing costs appears to have led to some buyers submitting lower offers’ and that ‘it’s common for the property market to experience a seasonal slowdown as the year comes to an end, especially around the Christmas holiday period’ with some movers opting to postpone their decision making until the New Year.

Over in the North West, the interest rate hold has had a positive impact. Stuart Matthews of Miller Metcalfe notes that October brought a ‘dynamic shift’ with ‘sellers and buyers making strategic moves now that interest rates seem to have stabilised’. He also notes ‘great resilience’, a view shared by Angi Cooney of c residential in the West Midlands, who says the market continues to exhibit ‘strength and resilience’ – ‘when properties are priced correctly, there are buyers’.

David Votta at Votta Sales and Lettings in the South East was pleased to report that sales are moving along faster, with a large number of potential sellers requesting valuations, although he warns that ‘there are still agents overvaluing to win the instruction’.

Finally, in Wales, Melfyn Williams of Williams & Goodwin says that despite the market cooling, ‘correctly priced property in the right locations should always attract attention’. He also warns that national headlines tell one story but ‘local and regional variances will be in force and it is important to discuss your goals with your local, experienced and qualified agent’. We couldn’t have put it better.

You can read the full report here.