Our latest Property Sentiment Index suggests the UK housing market remained impressively resilient during the recent festive season, despite the holidays being a historically quieter period.

While it wouldn’t have been unsurprising for movers who didn’t urgently need to buy or sell to take it slightly easier over the festive period, and given wider economic headwinds of the current climate, it’s all the more impressive that 71% of UK buyers were confident they’d move within the next three months in December, unchanged when compared to November. Meanwhile, 55% of sellers remained confident they’d sell within three months in December, only one percentage point lower than the previous month.

- 71% of active buyers in the UK were confident that they would purchase a property within the next 3 months

- 55% of sellers in the UK were confident that they would sell their property within the next 3 months

- 32% of properties were Sold Subject to Contract (SSTC) within 30 days of first being advertised for sale, compared with 38% in December 2022

- Mortgage rate reductions bolster confidence and improve buyer affordability

Our President, Jason Tebb, discusses the insights from our latest report:

Housing market activity tends to be muted in December. While those needing to buy or sell plough on regardless, those who don’t have the same urgency tend to take their foot off the gas and enjoy the festivities. However, the market remained surprisingly resilient this time around. Buyer sentiment continued to be strong in December with 71% of UK buyers confident they’d purchase a property within the next three months, consistent with November. Although vendors can become gloomy at this time of year if their property hasn’t sold ahead of the New Year, 55% of sellers remained confident that they would sell within three months, only one percentage point lower than the previous month.

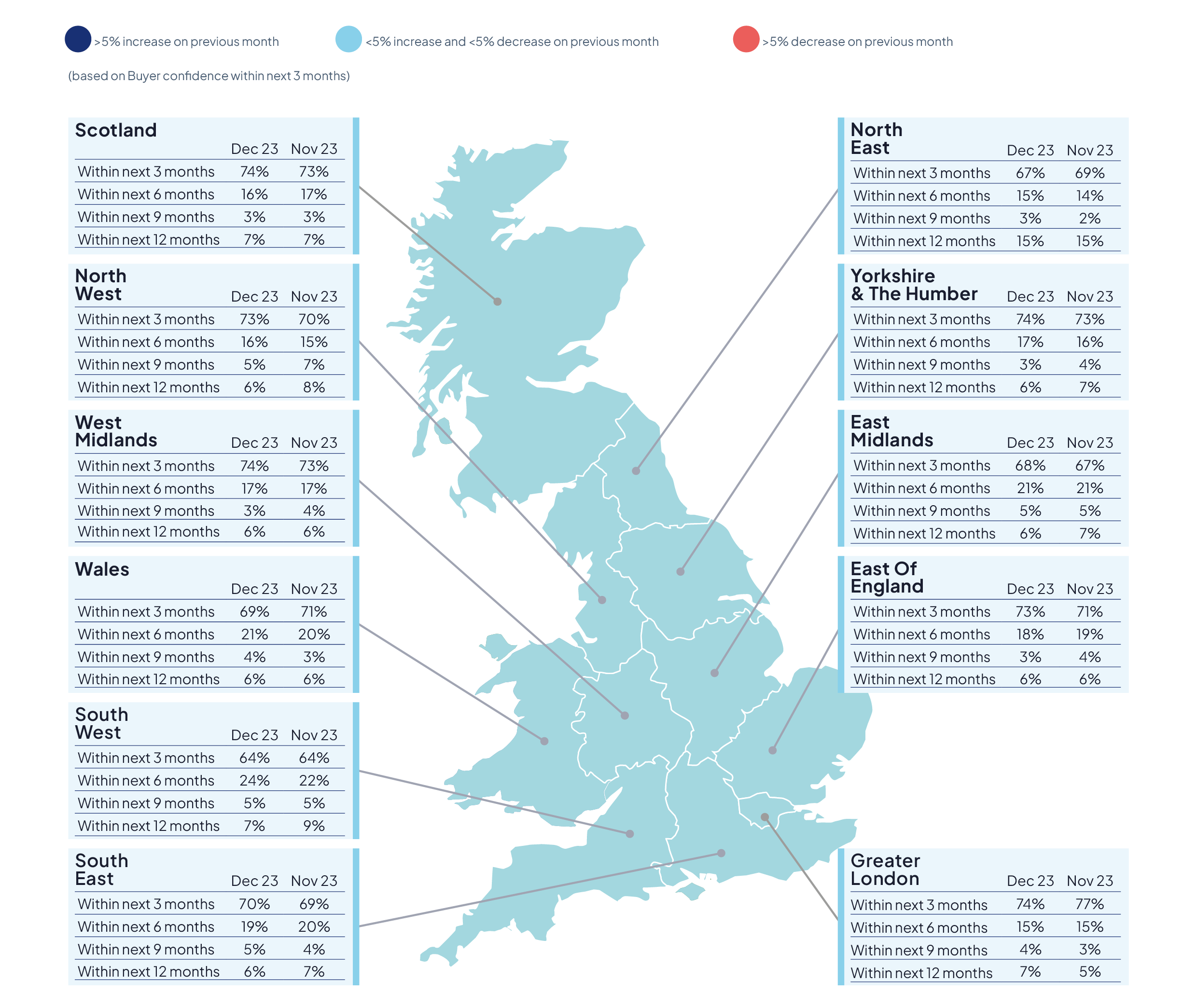

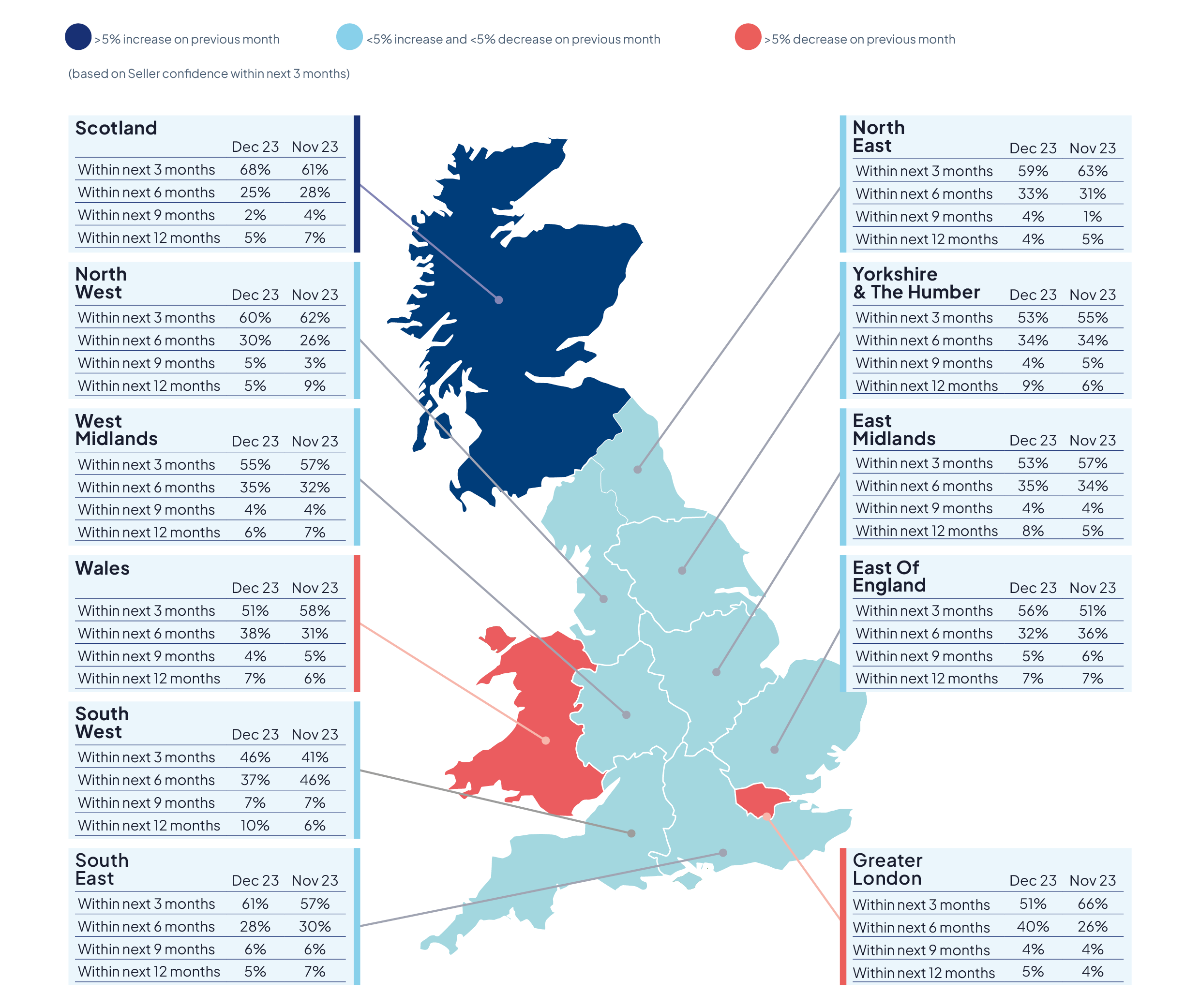

Regionally, sentiment among buyers remained fairly consistent. However, there were significant variations in seller sentiment, highlighting that the market is made up of many local markets which operate independently from one another. Seller confidence saw a 7 percentage-point increase in Scotland in December (68% compared with 61% in November), compared with a 7 percentage-point decrease in Wales (51% in December compared with 58% in November). The biggest variation was in London, which saw a 15 percentage-point decrease in seller confidence to 51% (compared to 66% in November). This may just be a Christmas blip, however, as our numbers (at the time of writing) for January 2024 suggest that seller confidence has picked up again. Anecdotally, some London agents are reporting that vendors whose properties had been on the market for a few months became less confident about their chances of finding a buyer as activity dipped in December.

On the mortgage front, 8% of movers were either very worried or slightly concerned about getting a loan in December, unchanged from November. This suggests borrowers have become more relaxed about the outlook for lending after three consecutive holds in base rate seem to indicate that the painful increases are over and that the next move by the Bank of England may be downwards. The reduction in Swap rates, which underpin the pricing of fixed-rate mortgages, has enabled lenders to reduce rates accordingly, resulting in a welcome return of sub-4 per cent five-year fixes, among other cheaper deals.

Although we might have expected a December dip in confidence, the data tells a different story. Those who forecasted a significant, double-digit drop in house prices may be proven wrong. Challenging macro-economic conditions mean property prices are off their peak but that’s not necessarily a bad thing for the overall health of the market and will bring some cheer for first-time buyers. Buyers who have been waiting to return to the market may well decide to get on with it, rather than continuing to put plans on hold. Although there will be a general election this year, many have already factored in a potential change of government and rather than worrying about what may or may not happen, are getting on with their own lives and taking advantage of more competitive mortgage rates.

State of the Nation

As the North East geared up for Christmas, adverse weather conditions resulted in a ‘scarcity of new homes entering the market, disrupting the usual flow of stock,’ according to John Nicholson at Dowen Auctions, Sales & Lettings. ‘Prospective buyers faced limited options [which] created an environment of heightened competition for the available properties, potentially influencing pricing dynamics.’

Unsurprisingly activity was also quieter in Scotland, reports Alan Cumming of Aberdein Considine, as seasonal factors came into play. That said, ‘viewing activity remained strong across the central belt where, despite the challenges with higher interest rates, the market for all types of properties remains buoyant’. Encouragingly, he remains positive for the year ahead as pent-up demand in the market comes to fruition.

In Wales, a more optimistic outlook has been noticed by Melfyn Williams at Williams & Goodwin, although he advises sellers to continue to be cautious: ‘Property prices remain sensitive and now more than ever property entering the market needs to be at a realistic level. Overpricing at the outset could lead to longer selling times and inevitably a lower price in the long run.’

Finally, in Richmond, south west London, Alex Lyle of Antony Roberts, says: ‘If you asked sellers in December how confident they were about finding a buyer, they would have been pretty gloomy about their prospects. There is a fair chance they would have been on the market for some time as few choose to launch in December, so it would be likely that their property had been for sale since September or October, when the market was busier. Come December and if they haven’t sold by then, they may be thinking their chances have slipped.’

You can read the full report here.