Our latest Property Sentiment Index suggests the Bank of England’s decision to hold the interest rate in its last meeting in September brought a sense of stability to the housing market.

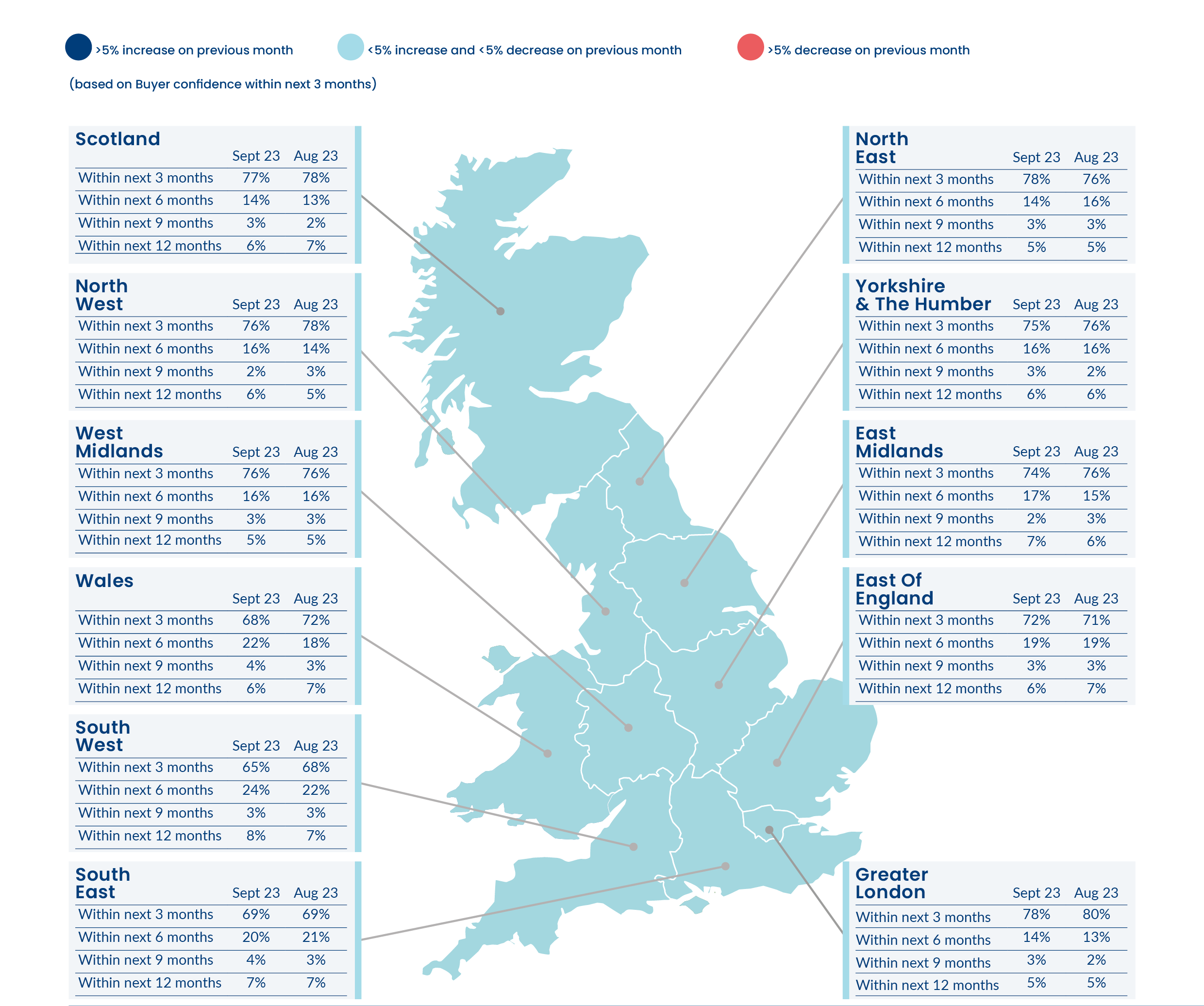

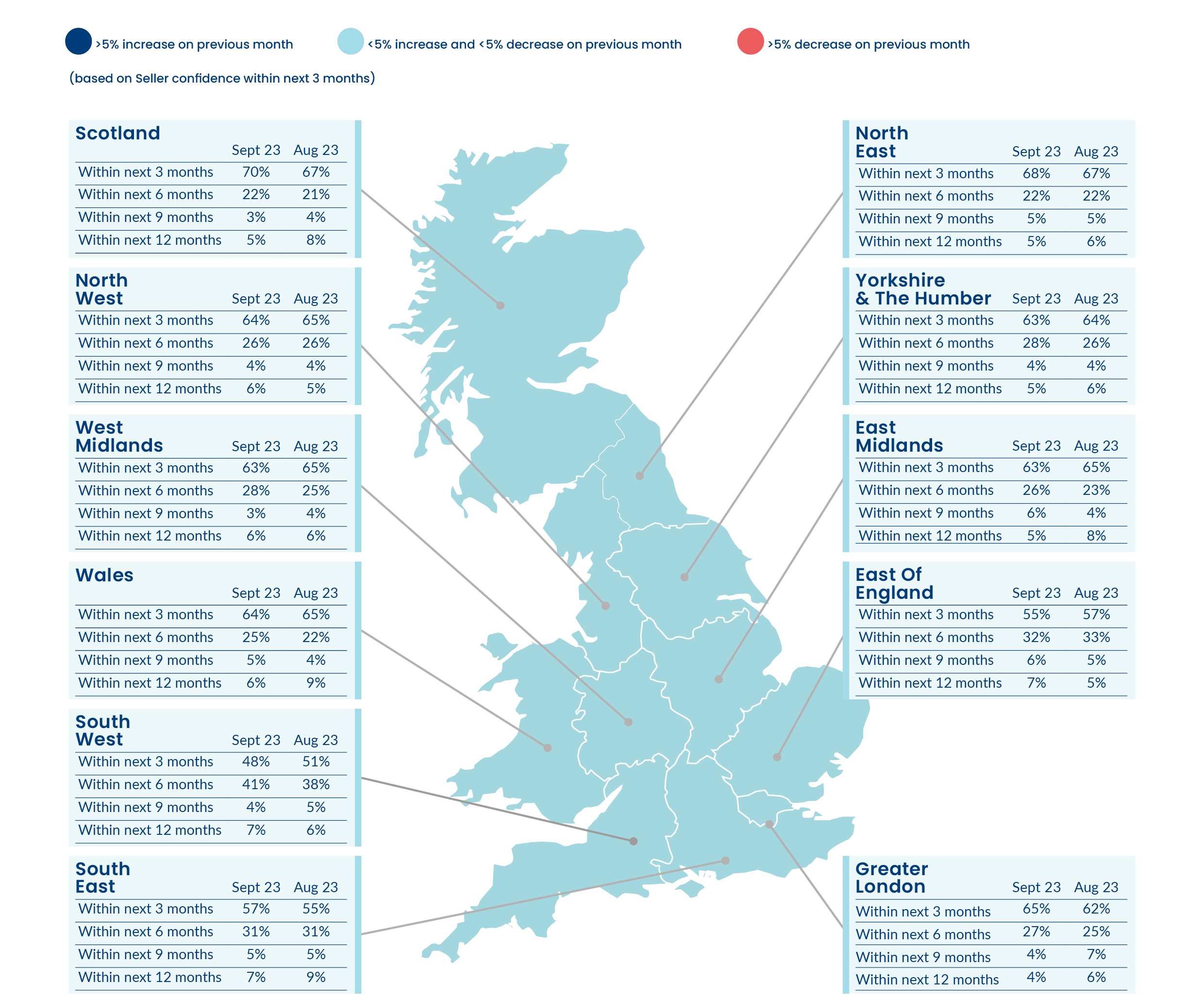

Sentiment among buyers and sellers remained consistent, with those serious about moving showing resilience in the face of economic headwinds. 74% of active buyers were confident they’d purchase a property within the next three months in September, compared to 75% in August, while 61% of sellers were confident they’d sell within three months, unchanged when compared to seller confidence in August (61%).

- 74% of active buyers in the UK were confident that they would purchase a property within the next 3 months

- 61% of sellers in the UK were confident that they would sell their property within the next 3 months

- 37% of properties were Sold Subject to Contract (SSTC) within 30 days of first being advertised for sale, compared with 53% in September 2022

- Rate hold boosts confidence in ability to get a mortgage as lenders trim rates

Our Chief Executive Officer, Jason Tebb, discusses the insights from our latest report:

The housing market has been nothing if not consistent in recent months with our data showing that September saw no real shift in sentiment among buyers and sellers, as those motivated to move got on with it. The Bank of England’s decision to pause consecutive interest rate hikes, keeping base rate at 5.25 per cent, was well received and helped bring some welcome stability. Consumers are hoping that we’ve seen base rate peak, with the worst of the pain behind us. While rock-bottom deals are long gone and we must get used to paying more for our mortgages, it’s only when there is some stability and borrowers become less concerned about further rate hikes that they will get off their hands and make big decisions such as whether to move.

Our data shows that buyer and seller sentiment proved extremely resilient in September. Nearly three-quarters of buyers (74%) were confident that they’d purchase a property within the next three months compared to 75% in August. Seller confidence was less strong, perhaps reflecting the relative power of buyers compared with sellers but even so, 61% of UK sellers were confident that they’d sell within the next three months in September, unchanged from August. This resilience is further underlined when you consider that just over a third of properties (37%) were Sold Subject to Contract within 30 days of first being listed in September, only marginally down from 38% in August. The figure may be lower than the 53% in September 2022 when the market was more buoyant, but given prevailing economic headwinds, the high cost of living and elevated mortgage rates, this consistency and stability is noteworthy. Clearly, those properties which are priced sensibly are attracting buyers within a sensible timeframe.

Further competition is edging into the mortgage market, which bodes well. Lenders have money to lend and are keen to do so, with many reducing fixed-rate mortgages and easing criteria, offering better terms to self-employed borrowers and improved loan-to-income multiples to help with affordability. Sub-5 per cent fixes are available and more are expected in the fourth quarter.

While the markets expect another rate hold at the Bank’s November meeting, all eyes will be on inflation figures before then to see whether they continue moving in the right direction. Yet despite continued economic uncertainty, serious property seekers are proceeding regardless. The current market is not all about plummeting prices and transactions – far from it. Motivated buyers are still seeking properties, and so serious sellers who want to attract them must price sensitively, taking advice from an experienced local agent.

State of the Nation

The housing market is not a single entity but comprises many different regional markets, and we’re delighted to reflect this by including views from agents across the country in this month’s report (from page 8).

While the regions are different, sentiment is often similar with Melfyn Williams at Williams & Goodwin in Wales observing that movers are ‘getting on with it but with caution… with some becoming more realistic with pricing’, while Ashley Rolfe at Rolfe East in Greater London suggesting ‘this isn’t a time for the speculative ‘try the market’ approach. If you want to move and are being realistic with your expectations then you will transact as usual’.

Demonstrating that there can also be differences within regions, John Nicholson at Dowen Auctions, Sales & Lettings in the North East remarks that ‘while mortgage uncertainty is undoubtedly having an impact… the middle and top-end price ranges of the market remain active’. Elsewhere, uncertainty around mortgages and interest rates is putting the brakes on activity, with Stuart Matthews at Miller Metcalfe in the North West noting that ‘higher mortgage rates coupled with stricter lending criteria have deterred many prospective buyers’, although he reassures sellers that ‘there are still many active, good quality buyers out there’.

Back to pricing again, and David Votta at Votta Sales and Lettings in the South East acknowledges that September saw the lowest number of transactions since 2012, with ‘numerous properties languishing on the market primarily due to a lingering post-Covid pricing mindset among both sellers and agents’. Finally, on a more upbeat note, Mike Cleary at Sheldon Bosley Knight in the West Midlands remembers that the market reacted badly last year to the Truss mini-budget, so it will be ‘interesting to see how October performs with a more positive outlook slowly emerging’. Watch this space.

You can read the full report here.