Despite a prolonged period of uncertainty and macro-economic headwinds, our latest Property Sentiment Index suggests the property market returned to a more familiar sense of normality in February.

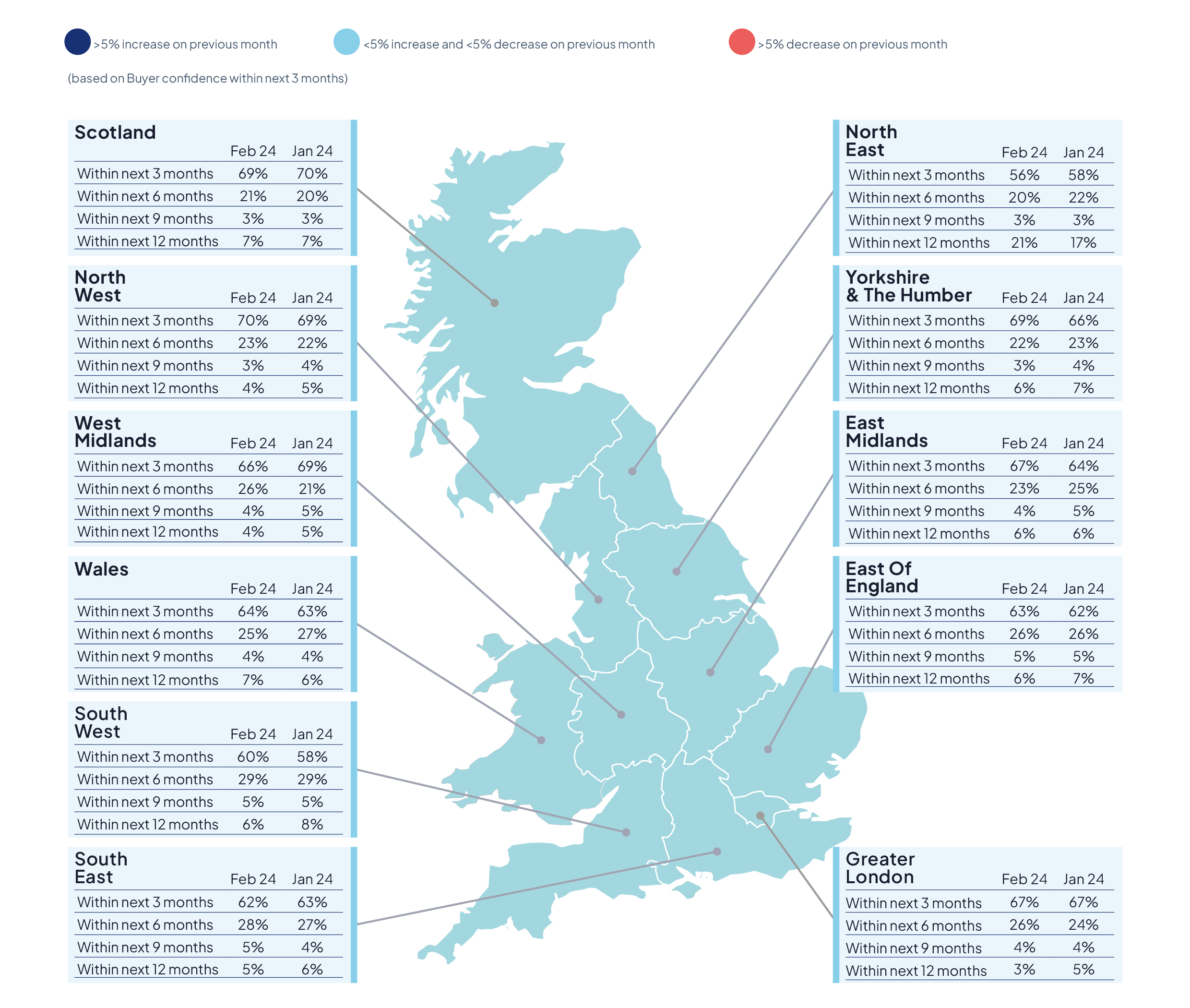

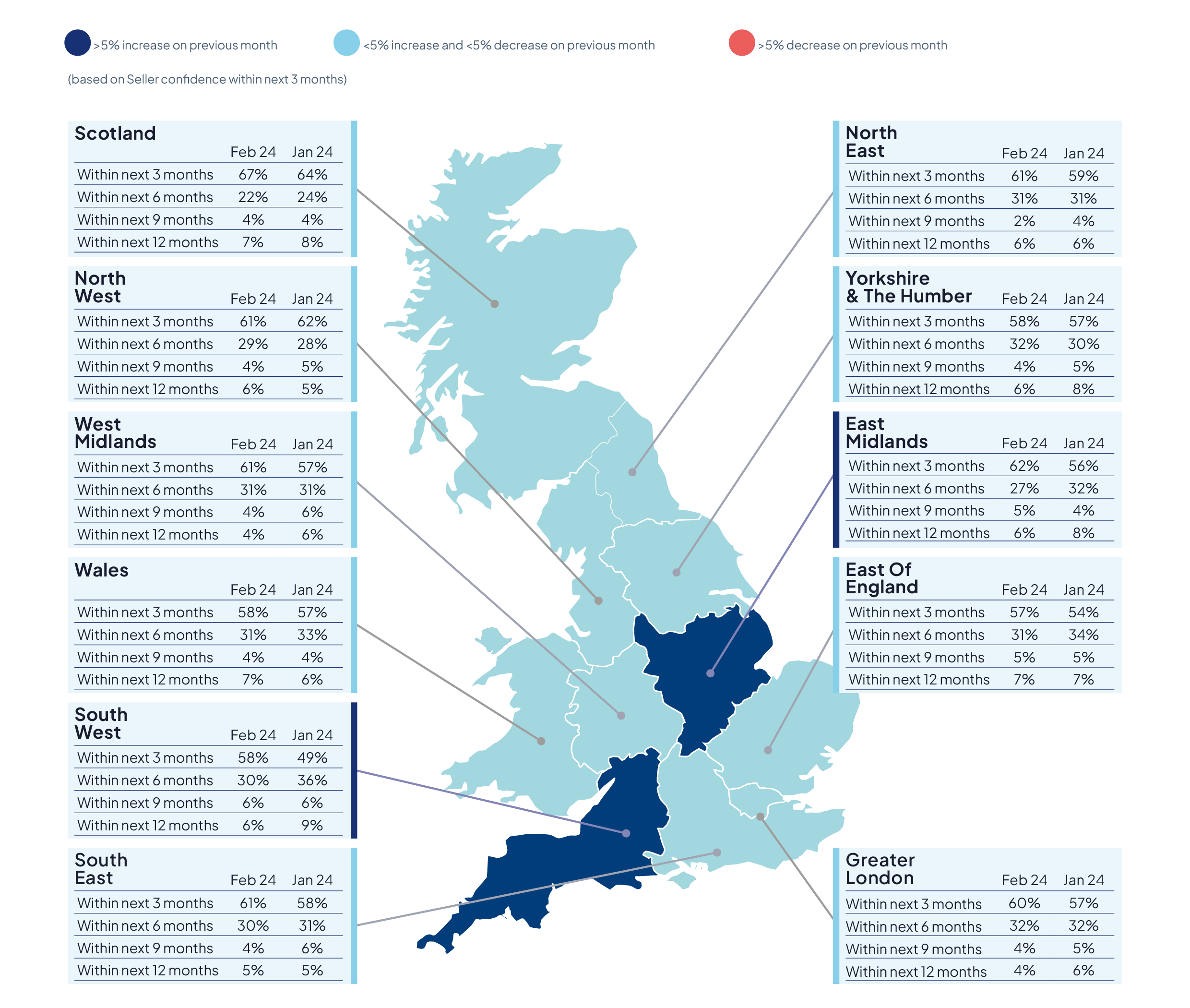

It appears property seekers were keen to get on with the business of moving with 65% of active UK buyers confident they’d purchase a home within three months in February, unchanged when compared to January. Meanwhile, 60% of sellers were confident they’d move within the next three months in February, an increase when compared to 57% in January.

- 65% of active buyers in the UK were confident that they would purchase a property within the next 3 months

- 60% of sellers in the UK were confident that they would sell their property within the next 3 months

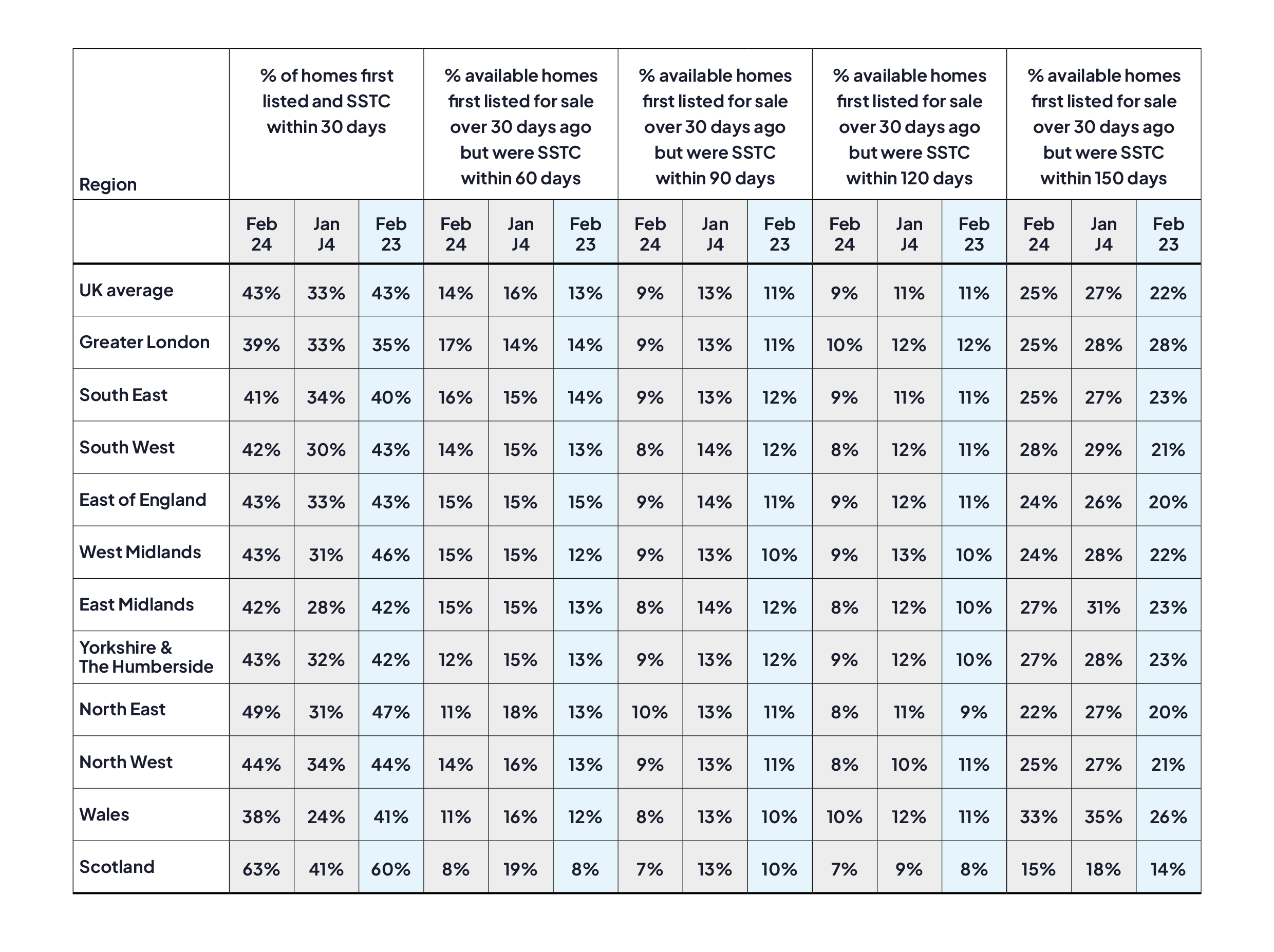

- 43% of properties were Sold Subject to Contract (SSTC) within 30 days of first being advertised for sale, compared with 43% in February 2023

- Borrowers adapting to ‘new normal’ of higher mortgage rates

Our President, Jason Tebb, discusses the insights from our latest report:

It appears as though the housing market resumed normal service in February. A ‘normal market’ is not to be sniffed at after two years of high levels of uncertainty around the macro-economic picture, governmental shifts, policy changes and the mini-Budget chaos which caused so much upheaval and soaring mortgage rates. Thankfully, the situation has calmed with our data suggesting we are back to more conventional seasonal markets with good levels of confidence prevailing across the board.

Buyer confidence continues to be stable – in February, 65% of UK buyers were confident they’d purchase a property within the next three months, unchanged from January. Meanwhile, seller confidence improved, with 60% of vendors confident they’d sell within three months, an improvement on January’s 57%. This may reflect the growing conviction around the likely trajectory of interest rates, with another rate hold in February further confirming expectations that rates have peaked and the next move will be downwards.

Sentiment suggests buyers and sellers are simply getting on with the business of moving. While inflation may still be twice the Bank of England’s 2% target, the worst of it seems to be behind us. Stock levels have increased, as one would expect at this time of year as normal seasonal aspects play out. While property prices have come off their peak a little in the past year, indices report a gentle uptick in national average prices rather than a continuing decline in values. As our data shows, there are regional variations with micro-markets behaving differently depending on local demand and stock levels. Overall though, the outlook for the market this year is far more positive than was the case several months ago.

Borrowers grew more concerned about securing a mortgage in February, with 8% either very or slightly concerned compared with 6% the previous month. This reflects rising mortgage rates, with lenders increasing their ‘best buy’ deals in February on the back of higher Swap rates, which underpin the pricing of fixed-rate mortgages. January’s mortgage rate war appears to have been short-lived yet borrowers seem to be coming to terms with the new normal – higher rates of around 4 or 4.5% rather than sub-1%, which simply wasn’t healthy or sustainable. There is bound to be a period of adjustment as borrowers are weaned off cheap credit, which will cause concerns around affordability, but those who want to move will have to adapt.

The data suggests they are doing so, with the worst of the nervousness about the market behind us as levels of properties Sold Subject to Contract within 30 days of first being listed increased to 43% in February, from 33% in January. As we move into spring, traditionally a busy time for the housing market when the leaves are budding on the trees and gardens look so much more inviting, transactions are picking up, with encouraging mortgage approval figures from the Bank of England. Buyers and sellers have been sitting back and waiting for some degree of stabilisation, which is where we find ourselves, notwithstanding the general election on the horizon. While there may still be bumps in the road, it feels as though the housing market is morphing into a more sustainable, encouraging state than the boom and bust of the past.

State of the Nation

Once again, we’re delighted to include views from agents across the country in this month’s Property Sentiment Index (see from page 8), which reaffirm a more positive outlook for the market in Feburary.

“Resilience” has been the key feature of the property market in and around Greater London so far this year, according to Daniel Collis of Gibbs Gillespie, reporting a 20% increase in buyer registrations, a 15% rise in sales agreed compared with the second half of 2023, and a “significant reduction” in sales falling through. “Sellers are now viewing the market as an ideal opportunity to move up the property ladder, motivated by the prospect of rising prices,” he says. “The optimism is shared by many, who are now pricing their homes sensibly.”

More stock also came to market in the North West, with Andrew Cardwell of Cardwells Estate Agents commenting: “Our offices surpassed their new instruction targets for the month comfortably… this is a continuation of strong levels seen in January, which is building to a property market potentially offering a little more choice for buyers than has previously been the case”. He notes that “hopes about immediately falling interest rates may be dwindling” following another rate hold in February but nevertheless, “sales agreed levels remained strong”.

Neil Parker at Leaders in the South East cautions that pricing is all important, particularly at the higher end of the market: “it is all about realistic pricing compared to the ‘bread and butter’ stock where we are seeing on average offers of 1 to 4% below asking price”.

Finally, in Wales, James Linder of Moginie James, reports strong activity with buyer registrations up 20% year-on-year and viewing numbers up 40% in January and February. “The reduction in mortgage rates and optimistic news surrounding inflation have bolstered buyer confidence, revitalising the market and encouraging a cycle of buying and selling,” he adds.

You can read the full report here.