The latest Money & Credit data for December 2023, released by the Bank of England today, shows a boost in market stability at the end of last year.

The insights stated that individuals repaid, on net, £0.8 billion of mortgage debt in December compared to net zero in November.

While house prices can give a temperature check of the market, mortgage approvals are an indicator of future borrowing and today’s stats from the Bank of England show that net mortgage approvals for house purchases increased from 49,300 in November to 50,500 in December. In addition, net approvals for re-mortgaging was 30,800 in December, up from 25,700 in November.

Promisingly, the effective interest rate, the actual interest paid, on newly drawn mortgages fell by 6 basis points to 5.28% in December which is the the first drop since November 2021 which will be welcome news for borrowers.

Commenting on the latest Bank of England Money & Credit data, Jason Tebb, President of OnTheMarket, says:

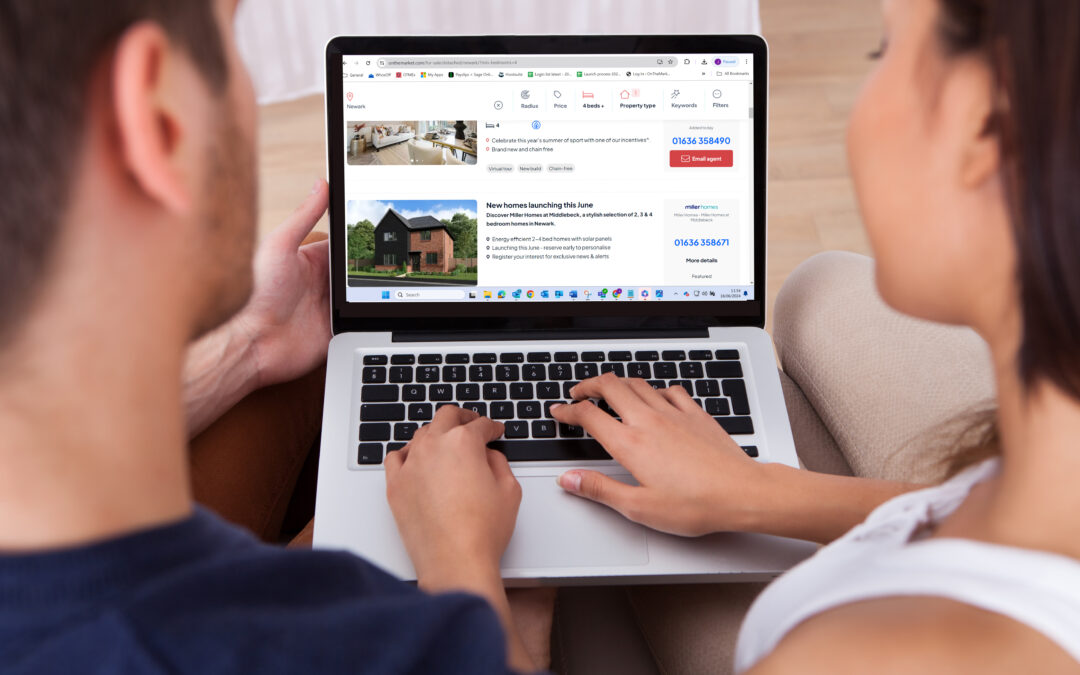

“With approvals for house purchases, an indicator of future borrowing, continuing to edge upwards in December, the pause in interest rate hikes is boosting market stability and buyer confidence. The end-of-year dip in confidence and activity which we might have expected failed to materialise.

The new year has got off to a promising start with an increase in buyer enquiries on the back of the reduction in mortgage rates. With the Bank of England expected to start cutting base rate at some point this year, buyers are increasingly confident as to what they can commit to and afford.

With property prices off their peak, that’s no bad thing for the overall health of the market as transaction numbers are more important. Sensible pricing should encourage buyers who may have been sitting on their hands to get on with their move and take advantage of more competitive mortgage rates.”