Our latest Property Sentiment Index highlights a sense of stability remained in the housing market at a time of year which is traditionally quieter.

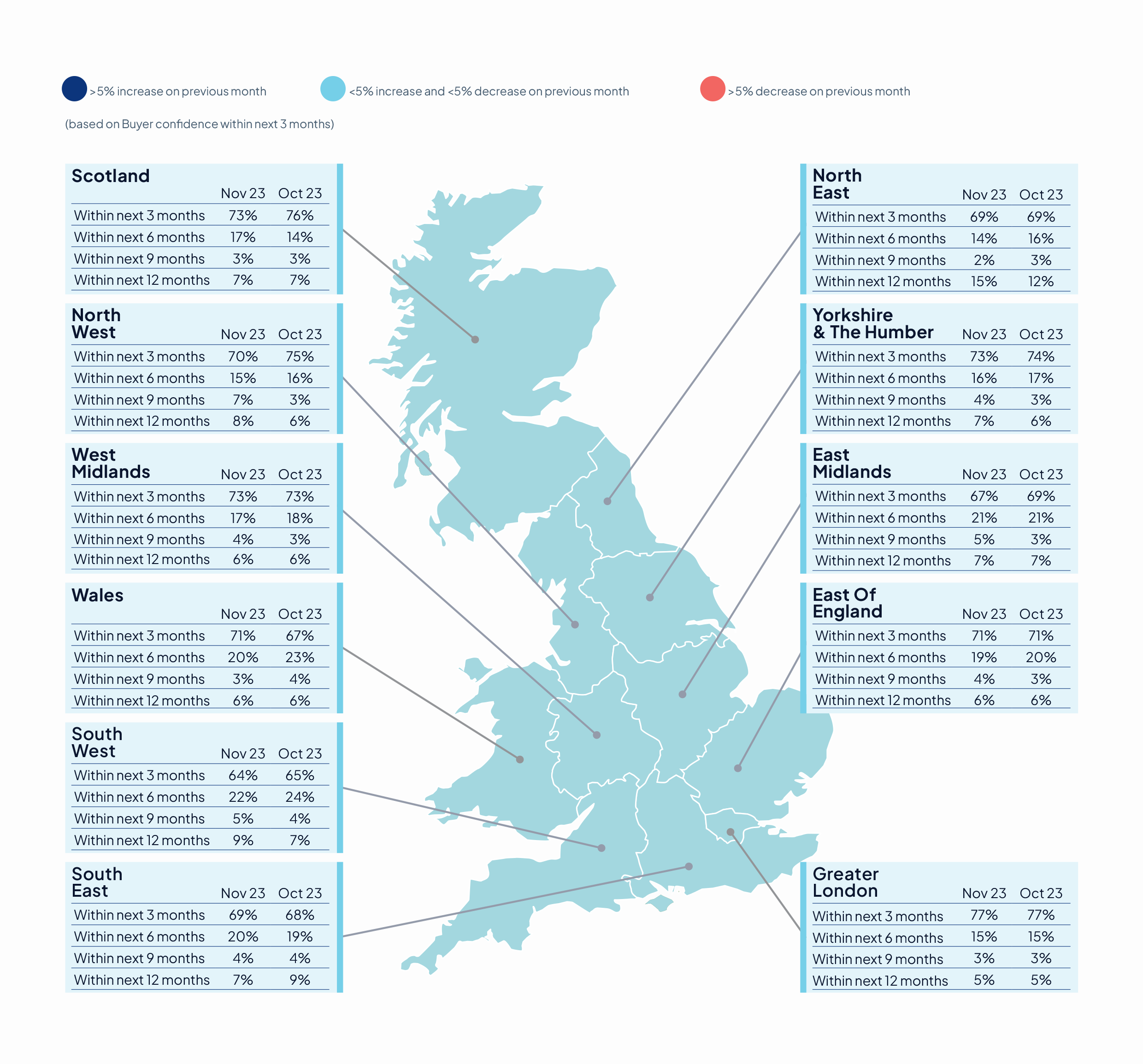

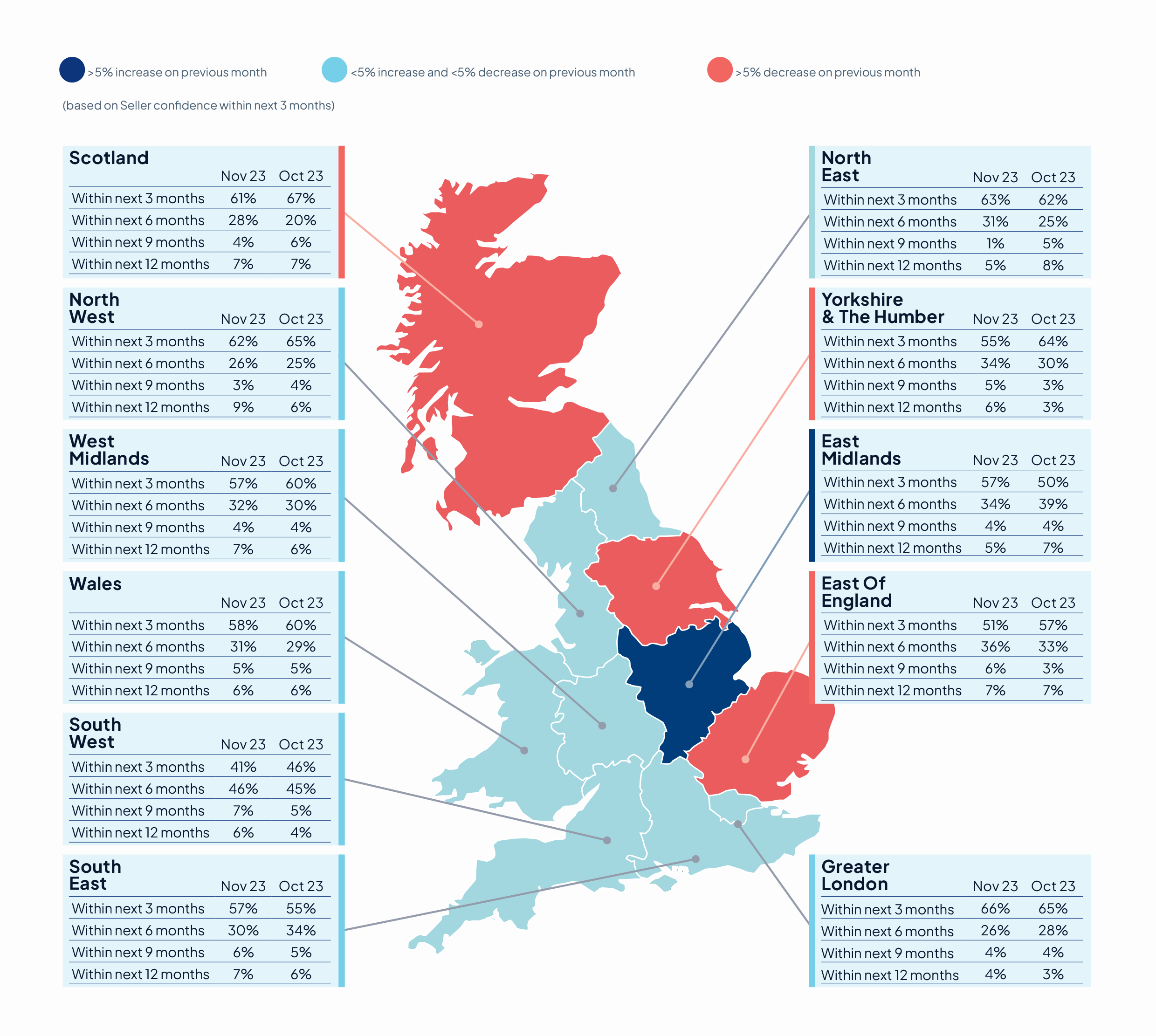

As there are rising hopes that interest rates have peaked following the Bank of England’s decision to hold rates for the second consecutive meeting in November, sentiment among buyers remained strong with 71% of buyers confident they’d purchase a home within the next three months, compared to 72% in October. When looking at seller sentiment, 56% of sellers were confident they’d sell their property within three months, down slightly when compared to 58% in October, though still strong when taking seasonal factors into account.

-

- 71% of active buyers in the UK were confident that they would purchase a property within the next 3 months

- 56% of sellers in the UK were confident that they would sell their property within the next 3 months

- 33% of properties were Sold Subject to Contract (SSTC) within 30 days of first being advertised for sale, compared with 42% in November 2022

- Buyer sentiment remarkably consistent, while seller confidence sees regional variations

Our Chief Executive Officer, Jason Tebb, discusses the insights from our latest report:

The Bank of England pressed the pause button on interest rates for the second consecutive meeting in November, raising hopes that base rate has peaked and the next move will be downwards. Although November tends to be a quieter month for the housing market, buyer sentiment remained fairly consistent, with just under three-quarters (71%) confident that they’d purchase a property within the next three months in November compared to 72% in October.

Seller confidence was lower and down slightly month-on-month, with 56% of UK sellers confident that they’d sell within the next three months in November, down from 58% in October. However, this is all the more impressive when you consider the seasonal effects at play at this time of year. Essentially, more than half of vendors believe they will sell within three months, even though this includes the festive period and January, which often gets off to a slow start. Regionally, there were some significant variations with a 6 percentage-point decrease in seller confidence in Scotland, while the East Midlands saw a 7 percentage-point increase in confidence, illustrating that instead of a single, homogenous market there are many local markets, susceptible to different influences.

Seller confidence was lower and down slightly month-on-month, with 56% of UK sellers confident that they’d sell within the next three months in November, down from 58% in October. However, this is all the more impressive when you consider the seasonal effects at play at this time of year. Essentially, more than half of vendors believe they will sell within three months, even though this includes the festive period and January, which often gets off to a slow start. Regionally, there were some significant variations with a 6 percentage-point decrease in seller confidence in Scotland, while the East Midlands saw a 7 percentage-point increase in confidence, illustrating that instead of a single, homogenous market there are many local markets, susceptible to different influences.

Just under a third of properties (33%) were Sold Subject to Contract within 30 days of first being listed for sale in November, down from 36% in October. This is the lowest level seen this year, suggesting stock levels are rising, providing more choice for serious property seekers and even more reason for those serious about selling to price sensibly.

There were growing mortgage concerns among some respondents, with 8% very worried or slightly concerned about securing a mortgage in November compared with 4% in October. This could be down to the month-on-month uptick in property prices as reported by Nationwide and Halifax, contradicting forecasters who had predicted that the market would tank. Those waiting for a 10 per cent drop in prices may now be realising that as this hasn’t materialised, they will have to take on a bigger mortgage than they originally planned, and don’t relish doing so in a high-rate environment. However, there is good news on the mortgage front; swap rates, which underpin the pricing of fixed-rate mortgages, continue to fall. Lenders need to lend and continue to reduce their fixed-rate mortgages to attract new business, with two- and five-year fixes now available from less than 4.5%.

Although borrowers must get used to a higher-rate environment, levels of confidence among buyers and sellers are surprisingly good. Those who want to get on with the business of moving are doing just that, and where sentiment fluctuates, it’s only by a few percentage points, demonstrating a resilient buyer and seller cohort shaking off what is happening macro-economically and simply getting on with it. Provided property is priced attractively, it is entirely possible to attract serious buyers.

State of the Nation

Once again, we’re delighted to include views from agents across the country in this month’s Property Sentiment Index (see from page 8).

‘Solid demand levels in the Bolton, Bury and Greater Manchester sales market, with strong, almost unseasonal levels of sales being agreed’ provided welcome news for Andrew Cardwell at Cardwells Estate Agents in the North West, although he noted that this is ‘primarily in the middle and lower price brackets’ with ‘more expensive properties… proving to be a little slower, perhaps in line with the cost of borrowing remaining high’.

In Scotland, David Corrie at Galbraith also noted a ‘steady volume of transactions and some good sales being achieved’ despite the economic headwinds that have prevailed throughout the year. However, he advised sellers to ‘take heed of their agent’s advice and the Home Report value on pricing’. He added: ‘where property is realistically priced, we are seeing a good deal of interest, ultimately delivering a better and swifter result for the seller’.

In Wales they have noticed a pre-Christmas lull but Melfyn Williams at Williams & Goodwin optimistically remarked that: ‘many are casting one eye to the New Year market with a hope of renewed confidence for 2024’. This is based on the feeling that interest rates have peaked and although they may stay at their current level for a while, ‘the outlook could be slightly lower rates towards the end of 2024’.

Property prices showed a modest increase during November in the West Midlands, with Angi Cooney at C residential noting that the ‘growth rate remains in line with national trends, reflecting a balanced and sustainable market’. She is also optimistic as to what is ahead, expecting the market to remain resilient in coming months, fuelled by lower mortgage rates.

Finally, in north London, Jeremy Leaf of Jeremy Leaf & Co, said: ‘With inflation and mortgage rates continuing their downwards trend, while mortgage approvals move in the opposite direction, it is clear confidence is improving’. He points to reduced fall throughs and softening prices rather than a significant correction, expecting more of the same as we head into 2024 with ‘a bit of new year optimism making itself felt in the market’.

You can read the full report here.