The announcement that the coronavirus lockdown is to be extended means there is no immediate end in sight to the issues with which the property industry is currently wrestling.

During the Government’s daily press conference on 16 April, Foreign Secretary Dominic Raab confirmed what had been widely expected – stringent social distancing measures in the UK would remain in place for at least another three weeks.

The results of the next review will be announced on 7 May, when it is hoped the rate of Covid-19 infections will be down to a level which might make the easing of restrictions possible.

This leaves potential buyers and sellers of property, as well as tenants and landlords, in much the same position as they have been since lockdown measures were announced on 23 March.

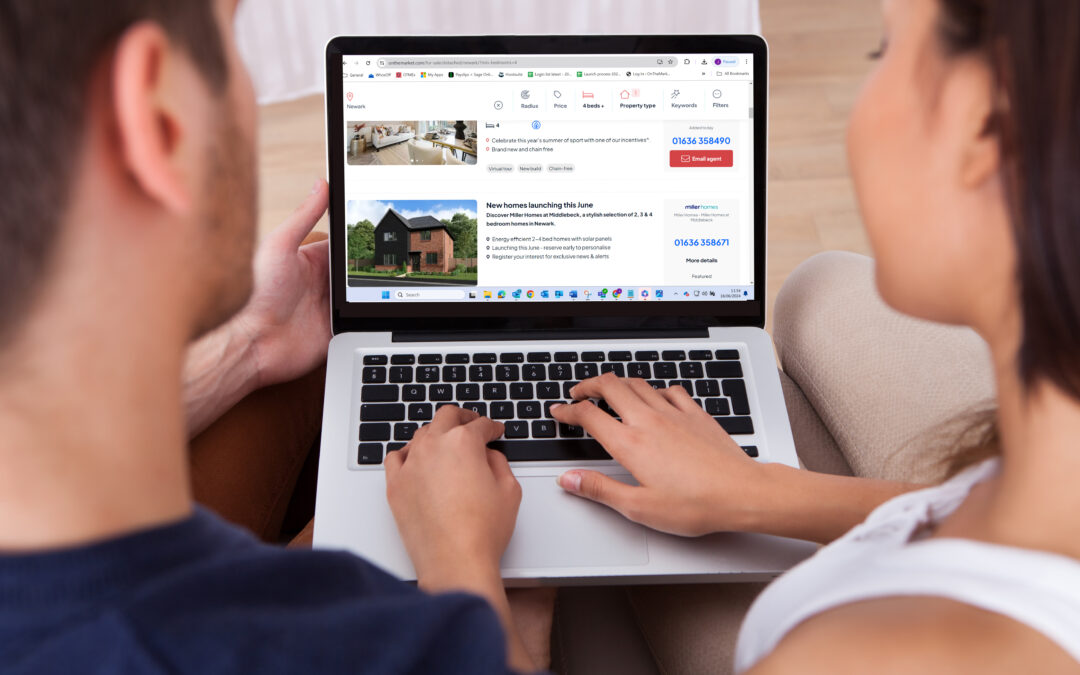

But there are some potential changes to the situation on the horizon, which OnTheMarket considers here.

Estate agents ‘should be among first businesses to reopen’ as coronavirus lockdown eases

Estate agents should be among the first High Street businesses to be allowed to reopen, according to a report written for the Government.

The Chairman of pharmaceutical company GlaxoSmithKline, Sir Jonathan Symonds, and Conservative peer Lord Gadhia, told ministers that agents are among the businesses whose reopening would pose the lowest risk of exacerbating the pandemic.

That’s according to newspaper stories quoting from the report.

“The initial focus for reopening the economy should be on sectors that have the greatest multiplier effects with minimum risks – such as coffee shops and restaurants which support agriculture,” the advice states.

“The property market is another that has wide multiplier effects. We need to avoid a stop-start economy which would sap public morale and damage business confidence yet further.”

The report has raised hopes that estate agents doing their best to serve customers during these most challenging of times might be able to get back to providing a full service quickly once the lockdown starts to ease.

Calls for stamp duty holiday to ease coronavirus lockdown difficulties

Calls for Stamp Duty Land Tax (SDLT) to be reformed or abolished completely have often been heard across the property industry.

But the Covid-19 pandemic has led to arguments for the tax to be added to the list of financial obligations for which relief is available.

The Royal Institution of Chartered Surveyors, the National Federation of Builders and Knight Frank have all called for a stamp duty holiday to be introduced.

Tom Bill, head of London residential research at Knight Frank, said: “The Government understands that moving house has enormous knock-on benefits for the wider economy.

Read more

- The best virtual property viewings you can do right now

- Coronavirus: Should you take your property off the market?

- Coronavirus: Virtual valuations and other tips for selling your home

“Anything it can do to kick-start the process once lockdown measures are relaxed will have ramifications far beyond the housing market.

“A material cut in stamp duty or an extended SDLT holiday should be central to these efforts.”

The practicalities of such a scheme would need to be worked out – for example, whether it would apply to buyers who completed in a given time frame and if buy-to-let investors would also be included.

But there is no doubt any movement from the Treasury on stamp duty would be a boon to the property industry at a very difficult time.

Coronavirus mortgage holiday scheme may need extending

Since it was announced on 17 March, more than 1.2 million homeowners have taken advantage of the scheme exempting mortgage holders from having to make payments for three months.

Those who have taken it up will see the missed payments added to their overall balance, which continues to accrue interest.

As a result, these customers will see their monthly mortgage payments increase when the scheme comes to an end in the middle of June.

Many of these homeowners, who may have lost their jobs or been furloughed as a result of the crisis, could struggle under such a burden.

This may prompt Chancellor Rishi Sunak to consider an extension to the coronavirus mortgage holiday scheme.

Crunch time for coronavirus furlough scheme

The Government’s scheme will see eligible firms who apply for it compensated up to 80 per cent of the salaries of employees up to £2,500 who agree to be furloughed.

This originally applied to employees furloughed from the start of March 2020 until the end of May. On 17 April, the Chancellor announced the extension of the Coronavirus Job Retention Scheme until the end of June.

The online portal to process the scheme went live on 20 April.

All those involved will be hoping payments flow as promised to provide support for furloughed estate agency staff and so that those who remain working from home can continue to serve customers as best they can without additional financial stress on the businesses they work for or run.

In-person viewings and valuations not possible during coronavirus lockdown

Homeowners looking to sell their properties should not allow visitors, be it to carry out valuations, surveys or viewings.

Those who already have their properties on the market are not obliged to take them off and are allowed to speak to agents with regards virtual viewings.

Home moves discouraged during coronavirus lockdown

Government advice on home moves still holds. Those who have exchanged contracts, and renters planning moves, should seek to delay the date ‘where possible’.

Only if a move is ‘unavoidable for contractual reasons’, or to an empty property, might it be permitted to go ahead, and only then if social distancing measures are observed.

OnTheMarket has a dedicated page for coronavirus information and advice.