This morning, Nationwide released their latest House Price Index and the Bank of England shared their latest Money and Credit data. Below, we discuss what these insights mean for the housing market.

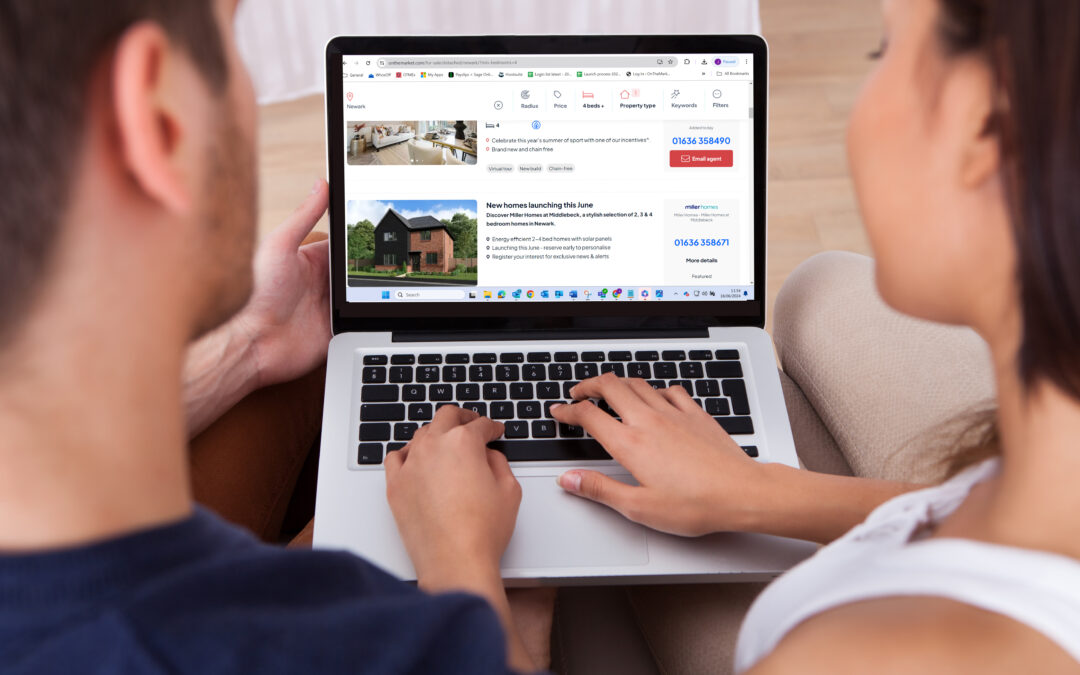

If you’re serious about moving, it’s important to keep up to date with what’s happening in the market to help inform your decisions and give wider context to the activity happening around you.

According to Nationwide’s House Price Index which came out today, annual house price growth softened in May and slipped back to -3.4% from -2.7% in April. When comparing house price change month-on-month, there was a -0.1% fall in prices in May and the average UK house price was reported to be £260,736 compared to £260,441 in April.

Following this report from Nationwide, the Bank of England also revealed their Money and Credit data for April this morning.

This data showed that borrowing of mortgage debt by individuals carried on declining from net zero in March to £1.4 billion of net repayments in April which is the lowest level since July 2021. In addition, net mortgage approvals for house purchases which are an indicator for future borrowing decreased from 51,500 in March to 48,700 in April, whereas approvals for remortgaging with a different lender increased slightly from 32,200 in March to 32,500 in April.

Our Chief Executive Officer, Jason Tebb, shares his thoughts on the latest insights:

“Annual house price growth declined again in May after some improvement in April, although Nationwide reports broadly flat prices over the month after taking seasonal effects into account.

Just as a welcome level of stability was returning to the market following the unprecedented uncertainty created by the min-Budget in the autumn, something comes along to upset the apple cart. The inflation figures, which while moving in the right direction are proving to be more stubborn than first thought, have created volatility in the money markets, resulting in lenders increasing their mortgage pricing.

In addition, with approvals for house purchases, an indicator of future borrowing, falling in April, the Bank of England figures suggest that there is some caution among buyers in light of consecutive interest rate rises and the high cost of living.

Since then, disappointing inflation figures, which while still falling are not doing so as fast as expected, could mean another interest rate rise may be on the cards at this month’s Monetary Policy Committee meeting.

While some may put their move on hold until the picture becomes clearer, there are those who need to get on with the business of moving. Sellers can achieve a successful outcome as long as they take advice from an experienced local agent and price realistically.”

Content provided by OnTheMarket.com is for information purposes only. Independent and professional advice should be taken before buying, selling, letting or renting property, or buying financial products.