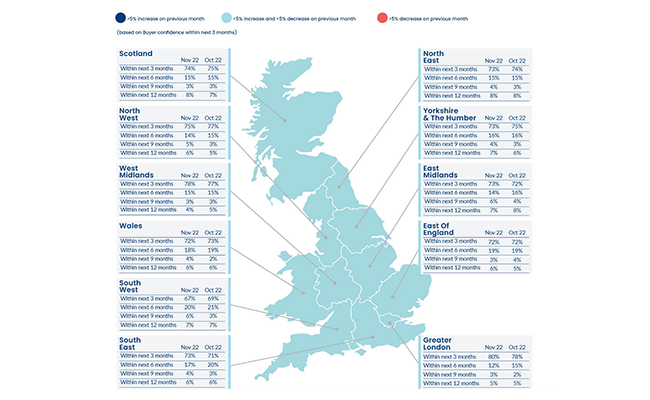

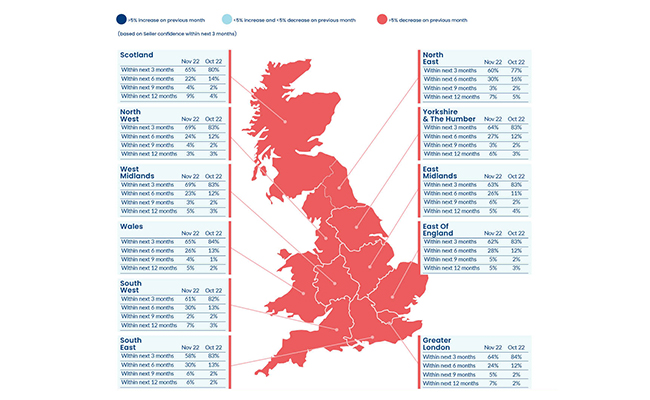

Our Property Sentiment Index shows that in November, sentiment remained strong among serious buyers while confidence among sellers in the short term decreased month on month, reflecting the slowdown in the market which was expected given current macro-economic challenges and seasonal factors.

Average UK buyer confidence remained the same as in October, but November saw a significant decrease in seller sentiment both as a UK average and across all regions when it came to sellers being confident they’d sell their home within the next three months.

While there was a noticeable shift in seller confidence in the short term, our data showed an increase in seller confidence in the medium term suggesting that as the market is continuing to rebalance, it’s doing so in a measured way.

- 74% of active buyers in the UK were confident that they would purchase a property within the next 3 months

- 63% of sellers in the UK were confident that they would sell their property within the next 3 months

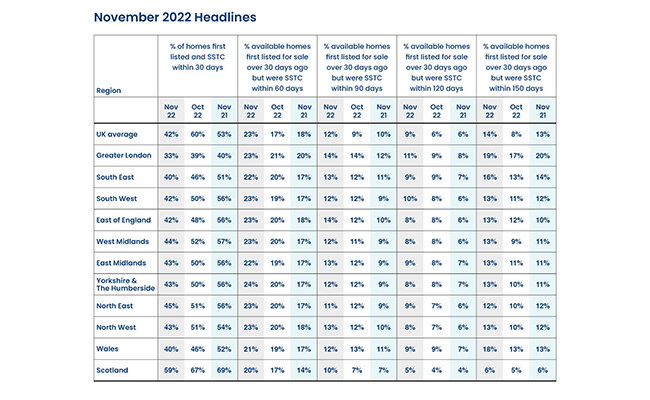

- 42% of properties were Sold Subject to Contract (SSTC) within 30 days of first being advertised for sale, compared with 53% in November 2021

- Subtle rebalancing as return to pre-Covid market continues

Our Chief Executive Officer, Jason Tebb, discusses the insights from our latest report:

November’s data illustrates the slowdown in the housing market which many anticipated. Continuing upheaval, challenges in the macro-economic climate and the chatter around mortgage rates – some fixed rates remain at much higher levels than we’ve become used to, despite a gentle, downwards trajectory – are bound to affect the confidence of average property-seeking consumers.

There are also seasonal factors to consider. Pre-pandemic, we’d expect the market to slow down at this time of year with thoughts turning towards the festive period rather than house hunting, and properties not looking their best for marketing purposes. As the market continues to rebalance and returns to one more akin to a pre-Covid market, seasonal factors will increasingly come into play.

While there are signs that the market is resetting, it’s doing so in a reassuringly measured way, rather than moving drastically. Indeed, 74% of buyers in November remained confident that they’d purchase a property within the next three months, which is consistent with October’s data. However, when it came to seller confidence, there was a noticeable dip. Our data shows that 63% of sellers were confident they’d sell their home within the next three months in November, compared with 82% the previous month. If we look at the data on a regional basis, every area saw a drop in seller confidence, with the largest fall in the South East (58% in November compared with 83% in October), perhaps reflecting the added challenges of getting a mortgage to afford relatively higher-priced properties. However, our data does not show that people are no longer confident about selling, just that they may be less confident about selling as quickly as they might have been even a month ago. This is reflected in our data which shows confidence in the medium-term has strengthened with 27% of sellers confident they’d sell their properties within the next six months, an increase when compared to October (13%).

While it may be taking longer to find a buyer compared with a year ago, 42% of properties were still SSTC within 30 days of first being listed in November. While this figure is down on 53% in November 2021, when you consider that there was comparatively less stock on the market then (27% less than November 2022), today’s market is proving to be pretty resilient, pointing towards a rebalancing, rather than a severe correction.

With the fallout from the mini-Budget, combined with seasonal factors, it’s unsurprising that consumers feel less confident in the short term. Uncertainty around mortgage pricing and continued rising interest rates are bound to have a knock-on effect on affordability. But it doesn’t necessarily follow that these will translate into longer-term concerns; people move for different reasons and that isn’t going to change, even if market conditions are tougher.

As the market continues to rebalance, those serious about selling in the meantime must remember the value of an experienced local agent and the importance of realistically pricing their home. This will ensure they market their property at the right price initially, with the transaction steered through to successful completion, even if it does take a little longer.