Property Sentiment Index, September 2025

The OnTheMarket Property Sentiment Index explores how home movers are feeling about the property market, supported by data from our own platform. This edition shows that the public expect both sales and rental prices to rise over the next 12 months while those planning to buy, sell or rent remain confident about making their move within the next three months or, at most, within a three-to-six-month timeframe.

Additionally, there is an appetite for reform within the property tax system, with only 12% wanting the current system to remain in place unchanged. However, opinions are split when it comes to choosing a replacement.

Sentiment towards the property market

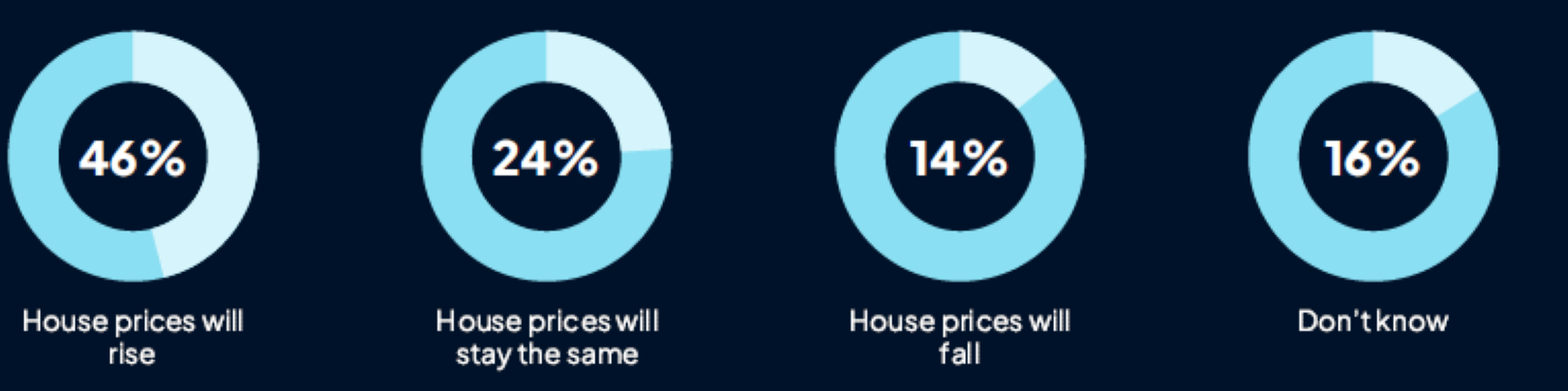

Sales market expectations

When looking ahead to the next 12 months, just under half of property seekers believe house prices will increase, a small fall from 51% who said the same three months ago, suggesting a slight wavering in confidence in the UK property market. Meanwhile, 24% believe prices will stay the same, up from 21% in the previous quarter, and only 13% expect house prices to fall.

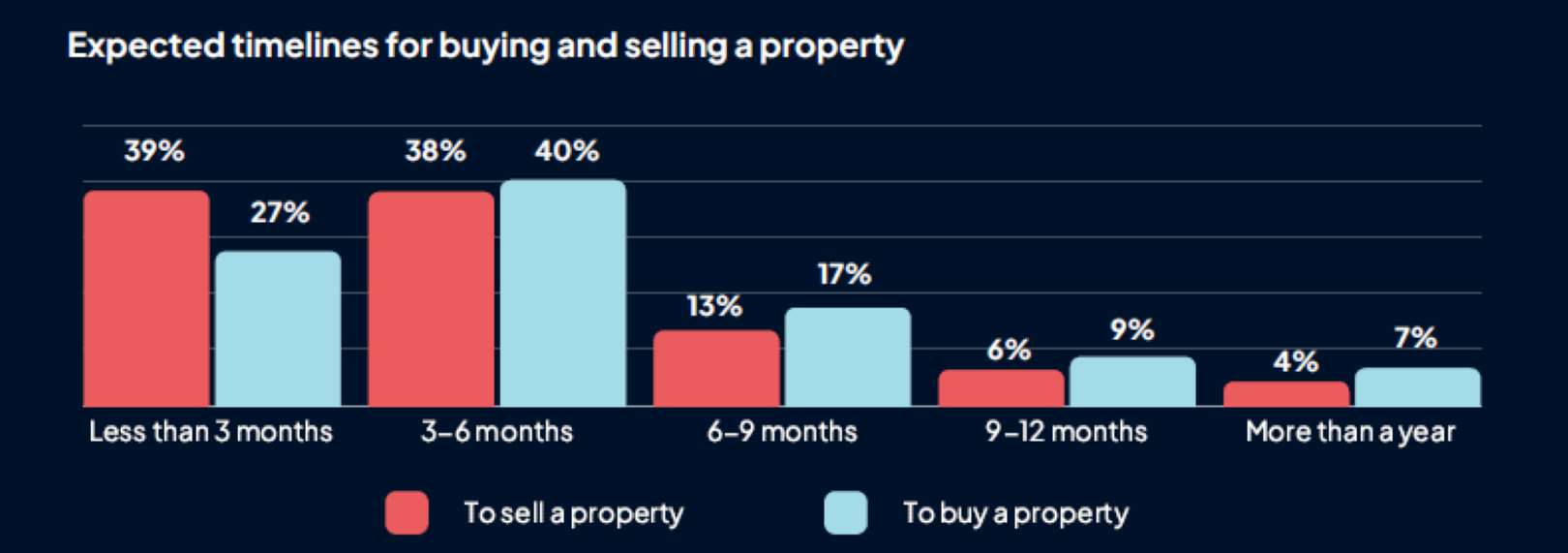

Seller expectations

Among those looking to sell a property, 51% of all respondents, four in ten (39%) expect to receive an acceptable offer within three months, while the same proportion believe this will happen in three to six months (38%). Just over one in ten (13%) predict they’ll accept an offer within six to nine months and 6% say within nine to twelve months.

Buyer outlook

Those looking to buy a property are generally confident that it won’t take long to find a home and have an offer accepted. Similarly to the June edition, four in ten believe this will happen in three to six months, while a further 27% expect it to take even less time. Just under a fifth (17%) expect their search to take between six and nine months.

Financial confidence

Buyers remain positive with eight in ten (80%) saying they are confident in their abilities to afford their next property purchase. This includes 52% who are very confident. Meanwhile, 15% feel not very confident or not confident at all and 5% say they don’t know.

New homes

Interest in new homes has remained steady among property seekers, with 42% likely to consider one as their next property, a change from 46% in June. Meanwhile 38% say they are unlikely, up from 37% in June.

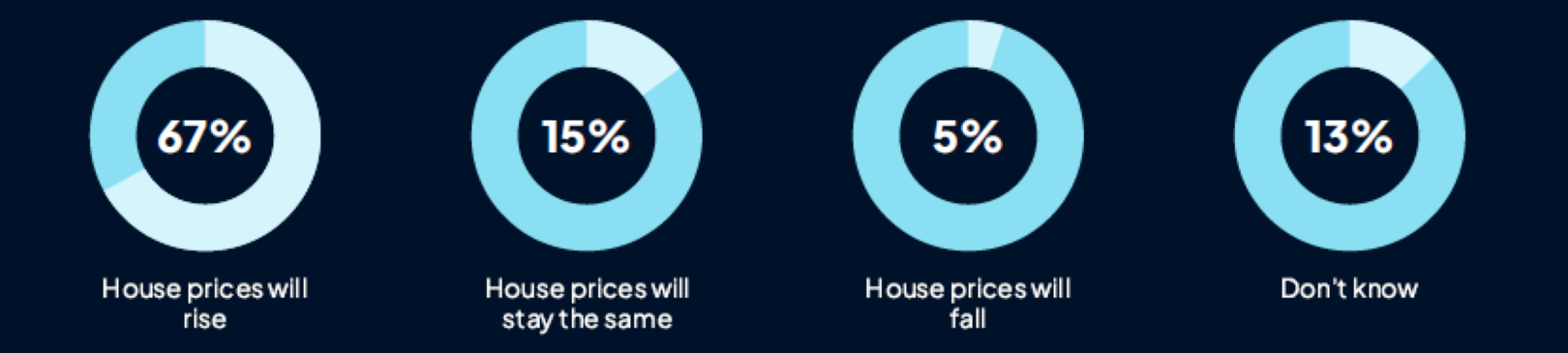

Rental market sentiment

Considering rental prices, expectations reflect the lack of supply and increasing demand, as two-thirds (67%) expect prices to increase, a similar proportion to June’s figure of 65%. Meanwhile, 15% believe rents will stay at the same level, while only 5% think they will fall.

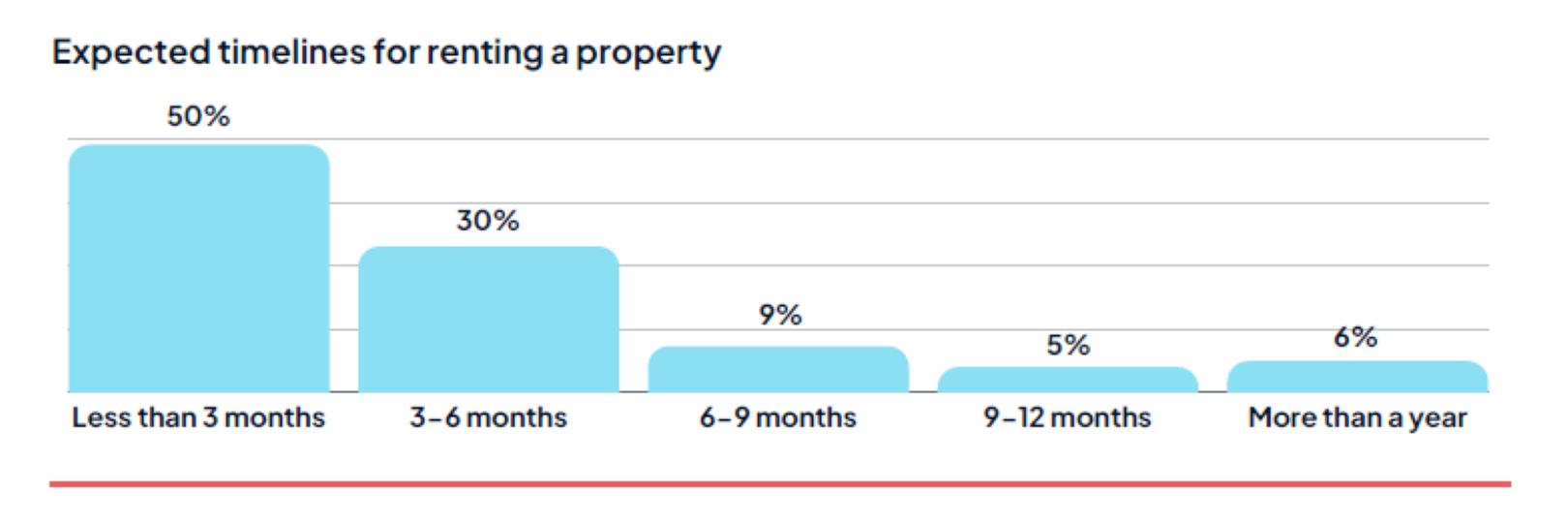

Renter outlook

Despite expectations for rents to increase, those looking to rent remain confident in their ability to find a property and have an offer accepted quickly. Half believe they’ll have an offer on a rental property accepted within three months and a further 30% expect it to take between three and six months. Fewer than one in ten (9%) believe it will take six to nine months (9%), with 5% expecting nine to twelve months and 6% foreseeing a wait of over a year.

Current events and policy developments

Housing targets

The government continues to face challenges in meeting its target of 1.5 million new homes, with skills and resources running low. It comes as no surprise, therefore, that almost half of respondents say the target is unlikely to be met. A quarter (26%) say it is very unlikely, while a further 21% believe it to be fairly unlikely. This represents little change compared to June’s results of 49%.

On the other hand, a quarter of respondents believe the government is likely to reach its target of new homes by the end of its term in 2029. Of these, 8% say it is very likely, while 18% believe it to be fairly likely.

Stamp duty

Since the end of the Stamp Duty holiday in March, there has been much discussion about whether the property tax system should evolve with a range of ideas floated so far. Among respondents, only 12% believe the current system should stay in place unchanged. A quarter are in favour of keeping the same criteria but spreading payments over several years rather than requiring them up front. Meanwhile, a similar proportion (21%) support the latest proposition of introducing a property tax on any property valued over £500,000, with a higher rate applied to properties worth over £1 million. Only 12% say they support none of these three policies and 30% said they don’t know.

Interest rates

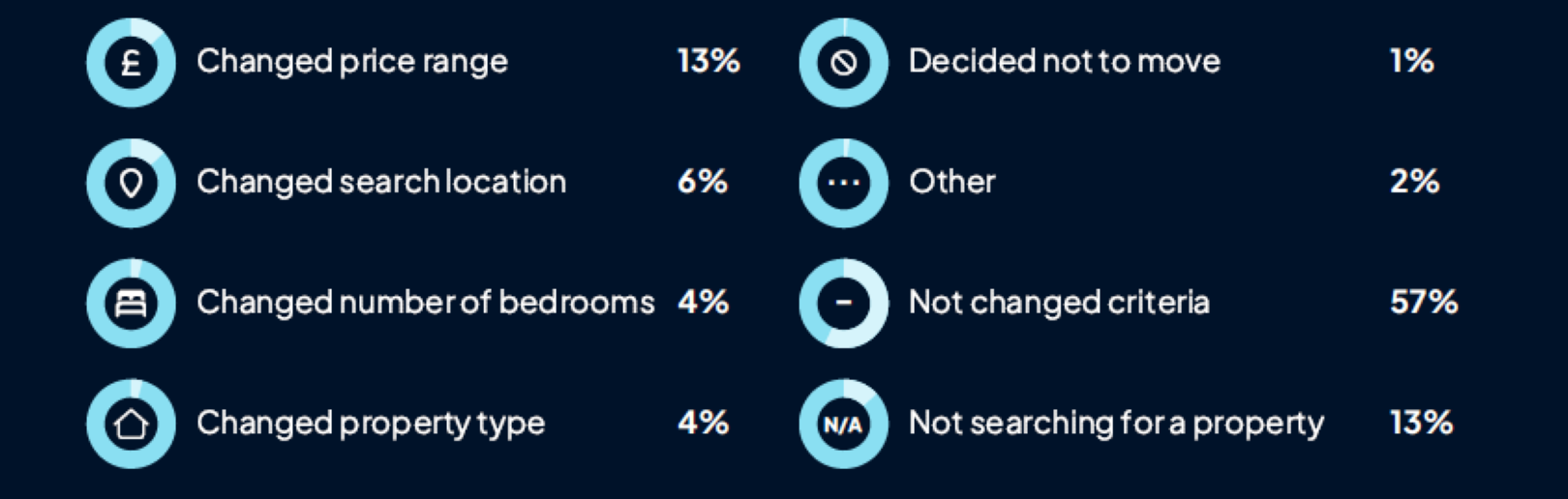

At the beginning of this year, the Bank of England’s base rate was set at 4.75% but has since dropped to 4%. In response, 30% of property In response,30% of property seekers say they’ve adjusted their search criteria. The most common change has been in searchers’ price ranges (13%), while 6% have changed the location of their search and 4% have altered the number of bedrooms in their prospective properties. Some respondents selecting “other” explained they had decided to rent rather than buy.

Looking to the future, opinions are mixed on what will happen to interest rates. A quarter of property seekers expect rates to continue to fall (26%), while just over a third (35%) believe they’ll stay at the current level. Less than one in five (17%) expect rates to rise again. Around a quarter (23%) say they don’t know.

Sentiment Summary

While confidence in the speed of transactions remains strong among buyers, sellers and renters, buyers are also feeling optimistic about their ability to raise the funds needed to purchase their next house.

Looking to current events, opinions are mixed on what the future of property tax looks like, with property seekers split as to whether the current system should be maintained or reformed. The year’s interest rates drops have affected the way some are searching for property, as many predict rates to stay at the current level or drop further.

We’ll continue to monitor shifts in sentiment and market activity in the months ahead and provide updated insights in our next edition. Keep reading for insights from OnTheMarket’s data and comments from agents around the country on their experiences over the last few months.

Insights from the OnTheMarket website

Keywords

Our keyword search tool helps property seekers refine their search based on specific features they want in their next home.

For buyers, outdoor space is a clear priority with gardens featuring in 31% of keyword searches. Parking is also highly sought after (17%) along with garages (12%) while freehold properties and rural homes atrract similar levels of interest (both 7%).

In the rental market, gardens again top the list, appearing in 29% of keyword searches, with parking once again close behind at 21%). Renters, however, have additional considerations with 11% search for “pets considered”, 10% for “bills included” and 7% for “furnished”.

Property types

Filtering by property types remains on of the most widely used search options.

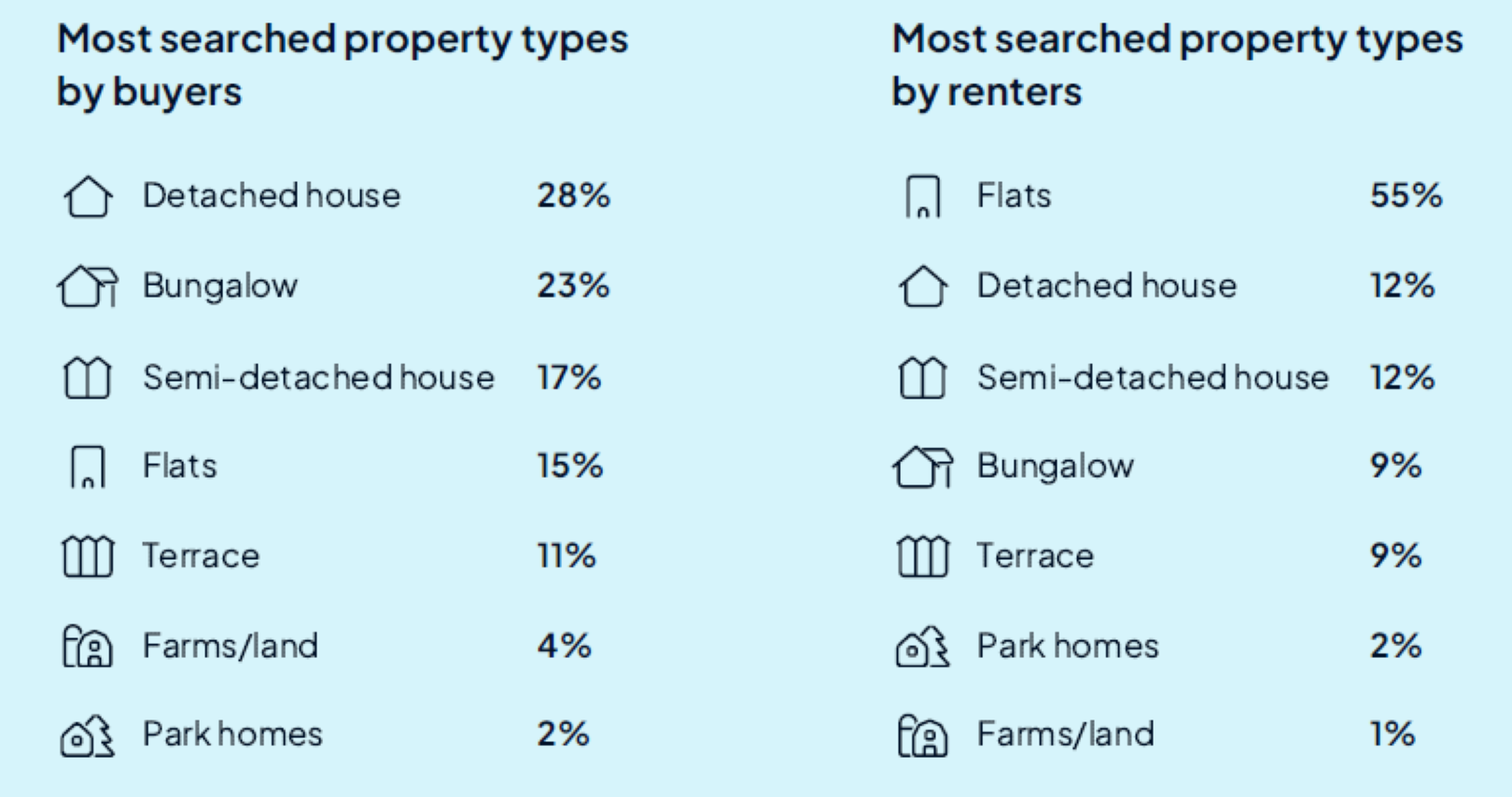

Among buyers, detached houses are the most popular choice (28%), closely followed by bungalows (23%). Semi-detached houses make up a further 17% of searches while flats account for 15%.

Renters, on the other hand, show a strong preference for flats, which dominate 55% of filtered searches. Detached and semi-detached houses share similar demand with 12% each, followed by bungalows and terraced houses, both with 9% of filtered searches.

New instructions

OnTheMarket has generally seen a growth in new listings in recent months, increasing by around 5% each month up to August. However, last month saw a seasonal dip, with new instruction falling by 15%, a common trend during the summer as many sellers delay moving plans while they go on holiday or enjoy the weather at home.

Price reductions

The proportion of properties with price reductions has remained relatively stable in recent months. In August, 11% of listings were reduced, compared with 14% in both June and July. This consistency suggests that the small shifts following the end of the Stamp Duty holiday are gradually returning to more familiar levels.

Agent insights

“With the November Budget on the horizon and ongoing economic uncertainty, buyers remain cautious and price sensitive. This year we have achieved record prices, both on a £ per square foot basis and in terms of real values in certain roads, where all properties have been turn-key.

“Many buyers are highly informed, often using £ per square foot as a benchmark before deciding which homes to view. While some are prepared to offer, persuading them to improve their bids can be challenging, as they want reassurance that their purchase will still represent good value after the Budget or in a few years’ time.

“With stock levels across London remaining high, bridging the gap between asking price and achievable sale price has been key. Sensible pricing not only reduces time on the market but can also help secure stronger results. In fact, we have achieved record prices for clients who adopted this approach.

“Conveyancing is currently taking around 6–8 weeks. We strongly recommend that sellers instruct solicitors early and prepare documentation in advance to avoid delays, which only add to buyer uncertainty.”

“What we’re seeing across the market are focused buyers keen to get deals over the line, with exchanges and new buyer registration levels on par with 2024, despite an uncertain economic and political landscape. The recent decision by the Bank of England to hold interest rates at 4% has demonstrated a focus on stability: a pause that allows the market to adjust gradually and with greater confidence over the longer-term.

“Whilst prices have adjusted in some local markets, others remain underpinned by high demand, creating a truly regionalised picture. Lifestyle-led moves continue to drive demand in locations like Tunbridge Wells, Chester and Colchester, where long-term value outweighs short-term volatility. Completions remain strong in commuter hubs like Sevenoaks and Hale, reflecting the resilience of micro-markets that offer connectivity, community and quality of life. While those determined to complete before Christmas are already deep into their transactions, cash buyers now have a valuable opportunity, with a wide selection of properties available to them.

“Homemovers are increasingly focused on the tangible realities of today’s housing landscape. Our recent research revealed that of the 15% of over 55s who plan to downsize would do so within the next year if stamp duty were removed or reduced on their onward purchase, reflective of pent-up demand and a possible wave of movers subject to the outcomes of the Autumn Budget.

“As we enter the final quarter of the year, the message is clear; buyers are committed but now more discerning. The priority for policy makers must be to offer further stability that can breed confidence, fuel transactions, and support homemovers on their journey.”

“After a surprisingly busy few months of transactional activity at all levels of the rural estate agency market, the drip feed of potential changes to the taxation of both housing and housing transactions has brought a layer of caution into the marketplace.

“At the higher end of the market – specifically around properties worth in excess of £1.5m – there is more caution as the possibility of introducing capital gains tax to principle private residences has been rumoured to be announced in November’s Budget.

“However, the market for properties worth less than £1.5m is standing up very well. Possible reforms to stamp duty are likely to be unlock activity among buyers, and our New Homes team are also very busy, which bodes well for the future of house building and home ownership.”

Methodology

Between Friday 22 and Saturday 30 August, over 2,500 active property seekers who have recently signed up for property alerts or sent a property enquiry at OnTheMarket participated in our survey. This group represents engaged individuals currently navigating the UK property market. Breaking respondents down into:

- 1331 (50%) are actively looking for a property to buy

- 1345 (51%) have a property to sell

- 1571 (59%) are actively looking for a property to rent

Where totals do not add up to 100%, this is due to rounding.

Data on keywords, property types, new instructions and reduced properties is for June to September and is drawn from OnTheMarket’s data compiled from thousands of estate agent branches and housebuilders who list their properties with OnTheMarket every month.

The data for keywords and property types is related to all searches that have used those filters and does not include information relating to searches without them.

For all enquiries, please contact Amelia Collins (acollins@onthemarket.com)

Previous editions of the Property Sentiment Index, as well as other reports can be found on our blog.