Stamp duty will remain unchanged except for an expected increase on purchases made by non-UK residents, the new Chancellor of the Exchequer has announced.

In a Budget with a strong focus on dealing with the coronavirus outbreak, many homebuyers had hoped Stamp Duty Land Tax would be abolished or at least reduced.

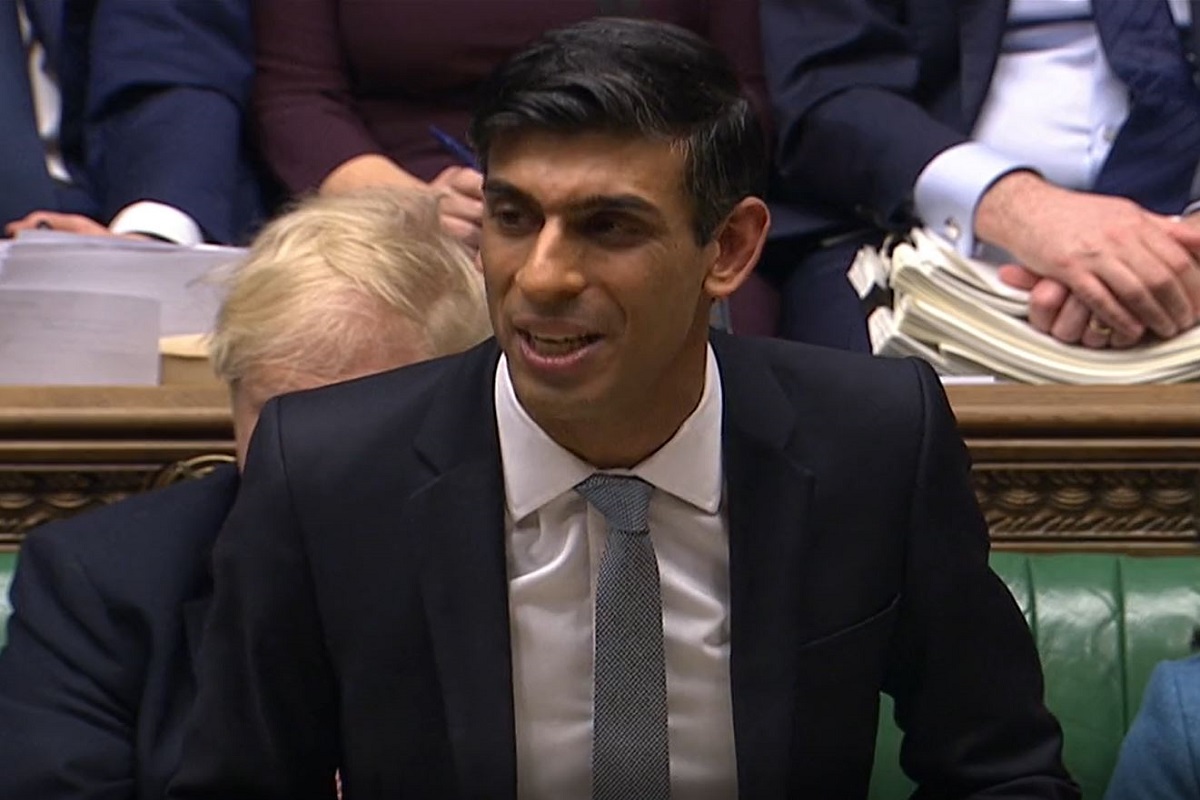

But Chancellor Rishi Sunak only made a marginal change to the tax which critics suggest ‘causes people to remain in homes that are ill-suited to their needs’.

Buyers of residential property in England and Northern Ireland with a sale price of more than £125,000 have to pay a levy of two per cent on the value between £125,000 and £250,000 and a proportion that rises in increments the higher the price of the property.

Sunak left this unchanged but introduced the additional surcharge of two per cent on property purchases in England and Northern Ireland made by non-UK residents – as mentioned in the Conservative manifesto. It will come into effect from April 2021.

The move is aimed at checking the flow of foreign capital into the UK property market, inflating values and turning ever-increasing numbers of homes, particularly in London, into nothing more than investments for non-UK buyers.

The £650 million which the Treasury expects the surcharge will raise, is to be directed to help around 6,000 rough sleepers into permanent accommodation.

During a speech of around an hour in the packed House of Commons, Sunak unveiled the Government’s measures on property in the final 10 minutes.

Other plans announced included:

- An extension of the Affordable Homes Programme with a ‘new, multi-year settlement of £12 billion’ to help finance the construction of new affordable homes

- £1.1 billion of allocations from the Housing Infrastructure Fund to build nearly 70,000 new homes in ‘high demand areas’

- Interest rates on lending for social housing to be cut by one percentage point

- £1 billion allocated to a new fund tasked with removing combustible cladding on all buildings more than 18 metres high following the Grenfell Tower disaster

- £400 million made available for mayoral combined authorities and local areas to build on brownfield land.

Sunak, who only took over from his predecessor Sajid Javid at the Treasury less than a month ago, also announced a business rates holiday over the next tax year for small and medium sized retail, leisure or hospitality firms in England and Wales with a rateable value less than £51,000.

This means more than half of all businesses in England and Wales won’t pay any business rates in 2020/21, according to the Chancellor.

But unfortunately estate agents’ high street branches are classified as offices not retail branches so they are – at present – not eligible for the rates relief offered to others on the high street.

The MP for Richmond in Yorkshire also claimed Housing Secretary Robert Jenrick would shortly announce planning reforms to bring the planning system ‘into the 21st Century’.

Read more

- The stamp duty reduction claim HMRC is cracking down on

- How to object to a planning application

- Conveyancing: Fees, finding a conveyancer and everything in between

Tom Bill, Head of London Residential Research at Knight Frank, said: “The introduction of a surcharge for overseas buyers will bring the UK into line with many other global property markets.

“Attempts to ease affordability pressures in the wider housing market should be welcomed, although the new measure will need to be monitored carefully to ensure there are no unintended consequences, including for the forward-funding of new-build developments.

“Furthermore, a wider re-think of stamp duty rates is still needed to increase housing market liquidity and maximise any stimulus the government plans to provide to the UK economy.”

Mark Hayward, chief executive of NAEA Propertymark, said: “Overseas buyers tend to purchase properties in prime central London which are completely unaffordable to most homebuyers anyway.

“Therefore, this move will not help those that need it most. Ultimately, by energising surcharges, it is likely that purchasers will factor this additional cost into any offers they make on a property so prices may be pushed down in areas where overseas buyers are purchasing.”