Despite economic headwinds, our Property Sentiment Index shows that in October, sentiment remained strong among serious buyers and sellers.

There were notable regional rises in seller confidence that they’ll purchase a property within the next three months in Wales, the South East and East Midlands.

This confidence could perhaps have been encouraged by the determination among buyers who have already secured attractive mortgage rates and are keen to proceed before their offers expire and will want to progress with their moves.

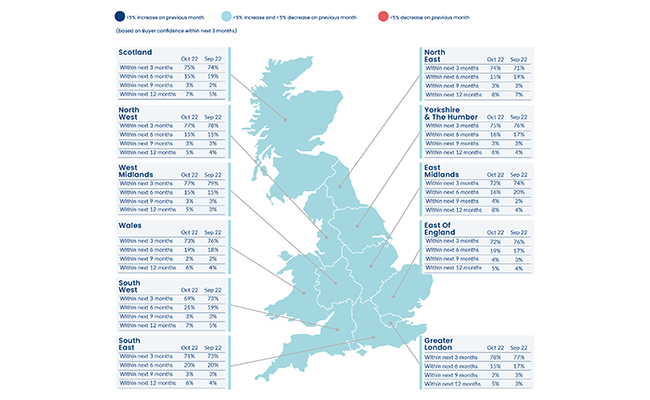

- 74% of active buyers in the UK were confident that they would purchase a property within the next 3 months

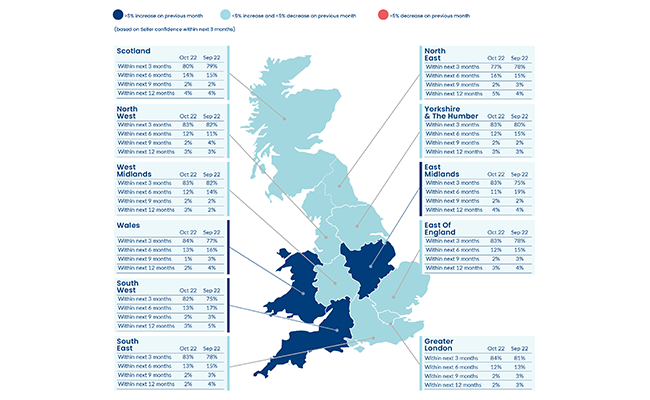

- 82% of sellers in the UK were confident that they would sell their property within the next 3 months

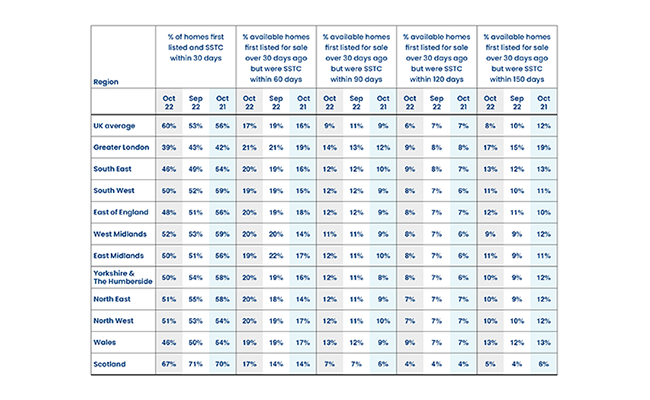

- 60% of properties were Sold Subject to Contract (SSTC) within 30 days of first being advertised for sale, compared with 56% in October 2021

- Buyers with relatively cheap secured mortgage deals keen to take advantage

Our Chief Executive Officer, Jason Tebb, discusses the insights from our latest report:

October may have been packed with political and economic uncertainty but remarkably, focussed buyers continued to go about their business of purchasing property. This buyer determination seems to have filtered through to sellers too, with 82% confident they’d sell their home within the next three months, up from 79% in September.

How long properties take to sell is one of the key indicators of the health of the housing market, and encouragingly, our data shows that this metric strengthened in October, despite rising mortgage rates and living costs. 60% of properties were Sold Subject to Contract (SSTC) within 30 days of being advertised for sale in October, a percentage not seen since June, and rather higher than the 53% recorded in September.

This increase in the volume of new properties going under offer within the first month of marketing may suggest an urgency among buyers with mortgage agreements secured some time ago, who may be keen to proceed before those offers expire. This is understandable as many of these rates will be significantly lower than current mortgage rates, which shot up following Swap rate volatility after the mini-Budget. This could be helping focus buyers’ minds and encourage them to put pressure on their conveyancers to get deals done before the expiry date. These buyers are unlikely to want to go back into the market at a higher rate unless they absolutely have to, as it could potentially end up costing them hundreds or even thousands of pounds extra a year.

The national average increase in seller sentiment masks some significant regional swings. Our data shows that in the East Midlands, seller confidence that they would sell their property within the next three months rose by 8 percentage points in October, while the South West and Wales both saw a 7 percentage points uptick in confidence. Meanwhile, in the North East, there was a 1 percentage point drop in seller confidence compared with September. It seems astonishing that despite macroeconomic headwinds, and predictions from many estate agents that property prices will fall next year, serious sellers and buyers alike remain keen to proceed. Estate agents providing appraisals to would-be sellers are in the strong position of being able to advise that rather than waiting until Spring to put their property on the market, they may wish to take advantage of this limited timeframe where there is a pool of focussed buyers with mortgage offers who are keen to proceed.

Some stability has returned to the market with the appointment of Rishi Sunak as Prime Minister and the reversal of many of the mini-Budget measures. However, mortgage rates remain significantly higher than they were this time last year – the days of sub-1 per cent fixed-rate mortgages are long gone. Challenges remain and the coming months are likely to be tough as the Bank of England raises rates further in an effort to bring inflation down. Encouragingly, however, the forecast for where rates might peak has fallen as some of the market turmoil has dissipated. Rock-bottom interest rates aren’t normal or sustainable and the new norm, which is slowly starting to establish itself, is beginning to look a lot like the old one.

You can read the full report here.