Lucian Cook, Savills‘ UK head of residential research, says political certainty provides a platform for growth but there are structural issues in the housing market which cannot be ignored.

The housing market survey from RICS indicates new buyer enquiries had started to weaken as early as the middle of 2014. This suggests the slowdown in transactions and mortgage approvals in the first quarter of this year were not solely about May’s general election.

The Nationwide house price index supports this, indicating that in the nine months to the end of May of this year UK house prices rose by a total of just 3.1%. Furthermore, three month on three month house price growth slowed to just 0.9%. This quashes claims that the stamp duty reform introduced in the pre–election Autumn Statement would cause a bounce in mainstream house prices.

These numbers undoubtedly reflect the fact that the Bank of England has imposed more regulation on mortgage lending, namely the Mortgage Market Review, conducted last April.

The Bank’s own credit conditions survey shows the impact of that regulation. This has been accompanied by a consistent fall in the proportion of mortgage applications being approved. The flipside is that this has also limited, and will continue to limit, access to home ownership. This creates a tension between the Bank’s desire to minimise risk in the housing market and politicians’ desire to get people on to the housing ladder, to obtain financial security.

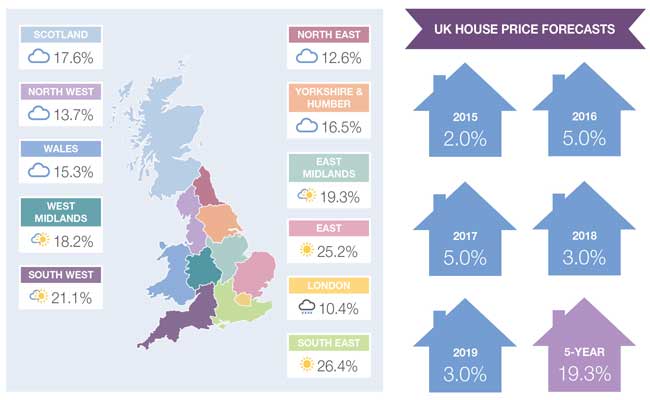

Mainstream markets: Five-year forecast values

Mainstream markets: Five-year forecast values

This desired financial security includes the aspiration that households will be able to reduce housing costs over time and eliminate them in retirement by progressively paying down mortgage debt. This is something that has served the baby boomer generation well. For example, our analysis shows that average annual housing costs where the head of the household is aged 65+ average just over £2,000 per year across England and Wales, the bulk of which relates to the minority who never realised the dream of home ownership. For those between the ages of 50 and 65 that cost averages £4,400 per year.

By contrast, the average for households under the age of 35 is just shy of £8,900, with rents paid to private landlords making up 57% of this sum. In London, where housing affordability is most stretched, that rises to £15,700 on average of which two thirds is made up of private rent. This means different generations increasingly view house price growth differently: at one end of the scale as a wealth generator, at the other as a barrier to home ownership which causes rent to make up a higher proportion of their lifetime housing costs.

These figures should be a reminder to politicians that there are major structural issues in the housing market that cannot be ignored – a widening gap between different generations and regional differences that are no longer confined to a simple north-south divide.

Whatever the policy response, these issues will change market behaviour. It will affect where people are able or choose to live, how often they move, how far they commute and their propensity to downsize in retirement. But none of this seems likely to dampen the nation’s obsession with house prices. Whether or not price growth is considered a good thing, it seems inevitable that it will continue in what remains a fundamentally undersupplied market.

While greater political certainty provides a platform for growth, the extent to which it is realisable is likely to be constrained (to a degree at least) by the mortgage regulation already imposed.

To read a fuller version of this report click here

See www.onthemarket.com/newandexclusive. Agents specify exclusivity and are committed to accuracy under terms of use.