Chancellor Rishi Sunak’s announcement of a temporary cut to stamp duty on residential properties is encouraging buyers to make that move.

Whether for those who are downsizing or looking to move from the city to the country, there is no doubt the move has given the market a shot in the arm.

The Chancellor said: “Nearly nine out of ten people buying a main home this year [in England and Northern Ireland], will pay no stamp duty at all.” There are also stamp duty reductions in place in Scotland and Wales.

According to Philip Norgan, Manager at Martin Kemps estate agent, the changes are already taking effect.

He said: “Demand for properties with gardens and in areas with green spaces has seen demand in the Chilterns and South Oxfordshire increase by 300 per cent on January/February figures and the stamp duty holiday has, in no small part, contributed towards this.”

But what are the details of the stamp duty savings package? And how does it compare with before? Let OnTheMarket be your guide.

Stamp duty explained

Stamp duty – officially known as Stamp Duty Land Tax (SDLT) – is a levy on property and land purchases in England and Northern Ireland, with the tax varying according to the price point.

In Scotland, it is known as Land and Buildings Transaction Tax (LBTT) and Land Transaction Tax (LTT) in Wales.

You can calculate your stamp duty here.

The changes in a nutshell

The reduced rates in England, Northern Ireland, Scotland and Wales will apply to residential properties until 31 March 2021, but the stamp duty holiday started from different dates – 15 July in Scotland, 27 July in Wales and 8 July in England and Northern Ireland.

In England and Northern Ireland, whether you are a first-time buyer or not, there is now no stamp duty on a residential property that is your main home up to £500,000, after which you start paying tax.

Before the changes, first-time buyers were exempt from the first £300,000 of a home and there was no levy on the first £125,000 for non-first-time buyers.

Read more

- What is my mortgage affordability? Everything you need to know

- A guide to choosing the right property survey

- Conveyancing: Fees, finding a conveyancer and everything in between

For additional properties worth more than £40,000 which are not your main home, for example buy-to-lets and second homes, buyers will still have to pay 3% on top of the reduced rates for main homes.

For Wales, the zero per cent threshold has increased from £180,000 to £250,000 for residential properties, and does not apply to additional properties such as second homes and buy-to-lets.

Similarly, for Scotland, the threshold for the 0% rate has been raised from £145,000 to £250,000. Second homes and buy-to-lets are usually subject in Scotland to the Additional Dwelling Supplement (ADS) – an extra 4% of LBTT.

Under the LBTT holiday, buyers of extra properties will also benefit from the 0% £250,000 threshold but must still pay the extra 4% LBTT of the total purchase price.

The figures – before and now

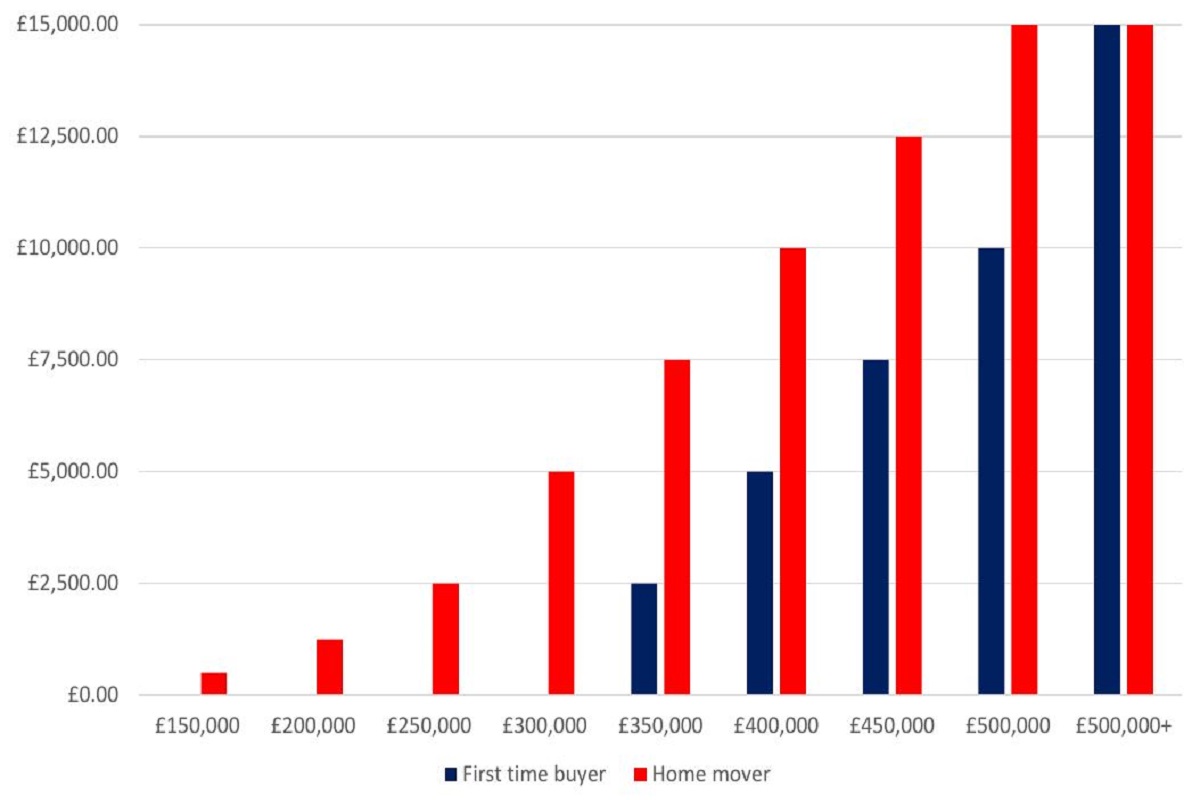

Here’s the difference for first-time buyers and non-first-time buyers before and after the stamp duty holiday in England and Northern Ireland.

Average stamp duty saving by purchase price

Expert views

Philip Norgan said: “I would recommend the Chancellor looks at what happens in March 2021. Firstly, he should agree to honour all sales agreed before the deadline that they will be exempt from SDLT and, secondly, spend the next eight months reviewing the structure of SDLT to make it fair for everyone.”

Kate Faulkner, Property Market Analyst and Commentator, added: “The stamp duty announcement was, for the short term and for some home movers, good news.

“For buyers within London and the South East, the saving for an average family home costing £400,000 to £500,000 is substantial.

“However, for those outside of these areas, the average price paid is typically £250,000 or less, so although it’s good to save up to £2,500 for the ‘average’ home in some areas, such as my home town of Nottingham, the saving would be just £370.”