Our latest Property Sentiment Index shows traditional seasonality returned to the housing market in August which saw fewer casual browsers, but serious buyers and sellers continued to press on with the business of moving.

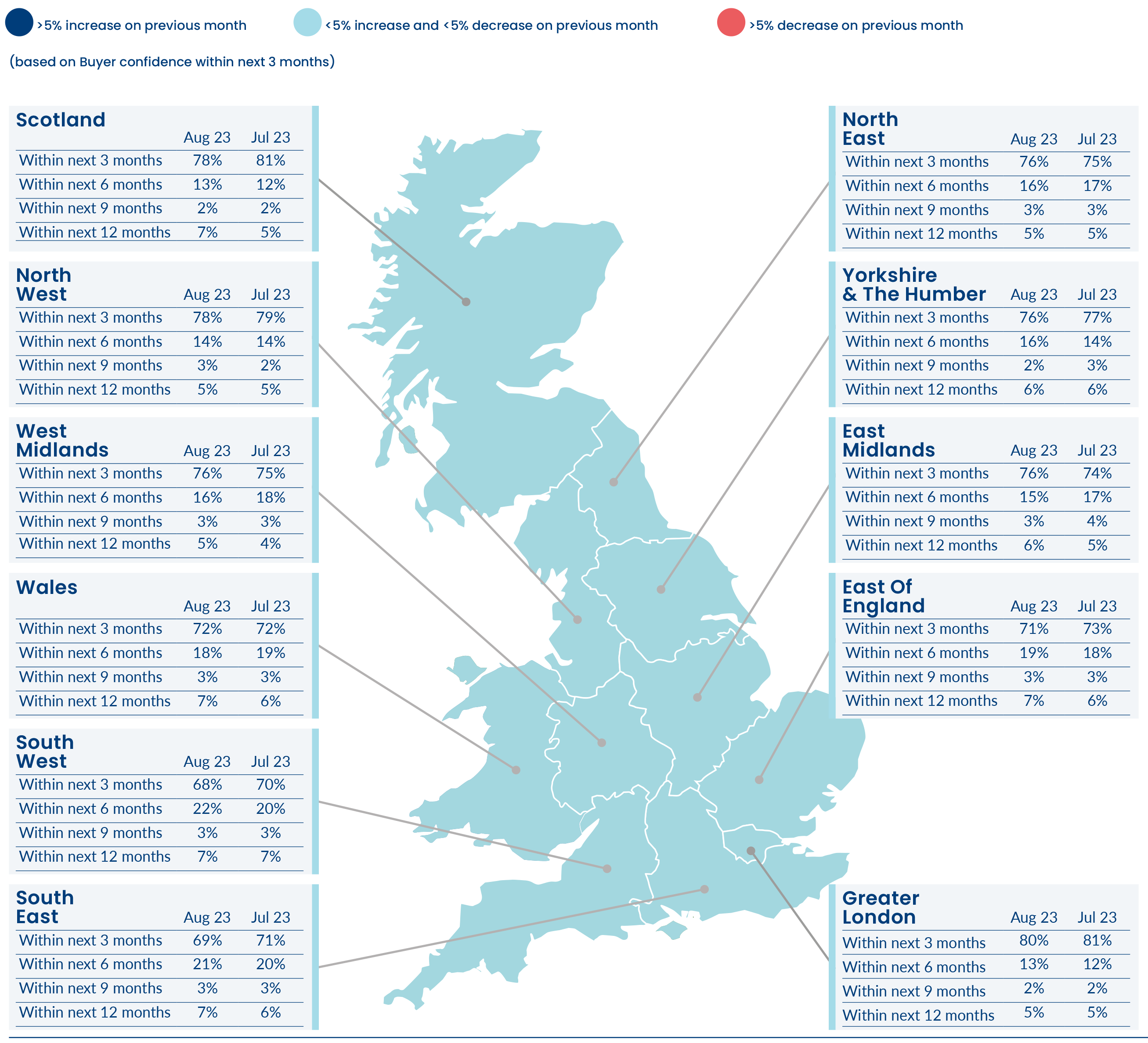

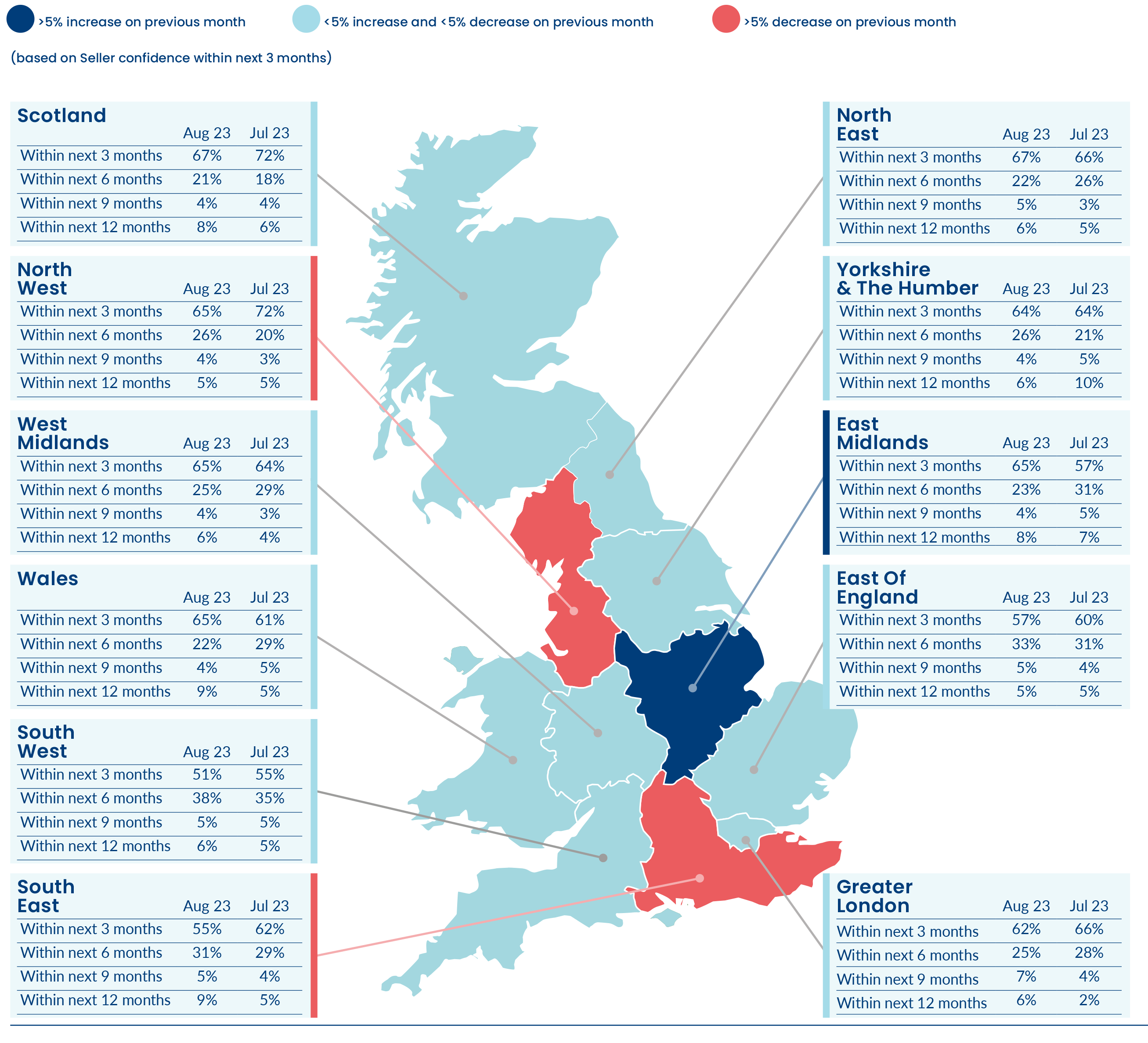

Despite continuing economic uncertainty, our data shows that buyers are remaining resilient with 75% confident they’d purchase a property within the next three months in August, compared to 76% in July. Seller sentiment was not as strong as buyer confidence in August, yet 61% of UK sellers were still confident they’d sell within the next three months compared to 63% in July.

- 75% of active buyers in the UK were confident that they would purchase a property within the next 3 months

- 61% of sellers in the UK were confident that they would sell their property within the next 3 months

- 38% of properties were Sold Subject to Contract (SSTC) within 30 days of first being advertised for sale, compared with 54% in August 2022

- Buyers hyper-sensitive on price, so sellers would be wise to take advice from an experienced local agent

Our Chief Executive Officer, Jason Tebb, discusses the insights from our latest report:

For the first August in a couple of years, traditional seasonality returned to the housing market. It felt quieter, as families took advantage of the school holidays and got away, rather than bought or sold houses. The backdrop of economic uncertainty, fuelled by numerous consecutive interest rate rises, the high cost of living and concerns over the Bank of England’s ability to rein in stubborn inflation, have amplified seasonal effects. As a consequence, August, a traditionally quiet month for the market, has felt even more so.

Despite everything, buyers are proving to be resilient, with three-quarters confident that they’d purchase a property within the next three months in August compared to 76% in July. Those property seekers who are out there are serious; transaction numbers may be down month on month but motivated buyers and sellers are proceeding, with over a third (38%) of properties Sold Subject To Contract within 30 days of first being listed for sale in August. It is unsurprising that this is down from 54% last August when the market was much busier, with significantly less property stock and abnormally high levels of demand, unusual for the height of summer and reflecting a very different market.

Seller sentiment was not as strong as buyer confidence in August, reflecting the shift in power toward the latter, but even so, 61% of UK sellers were confident that they’d sell within the next three months in August compared to 63% in July. There are regional variations, with confidence decreasing in the North West and South East to 65% and 55% respectively in August, compared to 72% and 62% in July, while rising in the East Midlands to 65% in August from 57% in July. This divergence may reflect the fact that sellers are usually hyper-sensitive to activity in their local market as this information is easy to come by, noticing how long properties take to sell and for how much.

Seller sentiment was not as strong as buyer confidence in August, reflecting the shift in power toward the latter, but even so, 61% of UK sellers were confident that they’d sell within the next three months in August compared to 63% in July. There are regional variations, with confidence decreasing in the North West and South East to 65% and 55% respectively in August, compared to 72% and 62% in July, while rising in the East Midlands to 65% in August from 57% in July. This divergence may reflect the fact that sellers are usually hyper-sensitive to activity in their local market as this information is easy to come by, noticing how long properties take to sell and for how much.

Challenging markets tend to shake out those who aren’t serious about moving as it’s more unlikely people will wish to view properties speculatively. In trickier conditions, it can be tempting to adopt a ‘wait and see’ approach until inflation is under control or mortgages are cheaper if there is no strong motivation to move. Those who remain tend to be serious buyers who have to purchase or are keen to but are hyper-sensitive to pricing: if they don’t think it’s sensible, they may not even commit to a viewing. Sellers should not be disheartened, as while buyers may be fewer in number, our data suggests that they are highly motivated. There is no reason why those sellers who take advice from a local agent and price sensitively can’t successfully transact.

While another rate rise can’t be ruled out, on the positive side, this has largely been priced in by lenders with a number reducing their mortgage rates recently.

You can read the full report here.